Extreme Investor Network: Will President Biden Drop Out and How Would It Affect Your Investments?

The financial world is abuzz with speculation and debates around the possibility of President Joe Biden dropping out of the 2024 election. This chatter has not only captured the attention of political pundits but has also sparked a flurry of activity on Wall Street, with traders repositioning their portfolios based on the potential outcomes of a Biden withdrawal.

As experts in the field of finance, we at Extreme Investor Network are closely monitoring these developments and keeping a keen eye on how they could impact various asset classes. In this article, we delve into the potential scenarios that could unfold if President Biden decides not to seek re-election, and how you can prepare your investments for these uncertainties.

Biden’s Debate Fallout and Market Reaction

After Biden’s lackluster debate performance against former President Donald Trump, concerns have been raised about Biden’s ability to serve another term. This has led to a significant shift in market sentiment, particularly in the bond market, where yields on 10-year Treasuries saw a sharp spike following the debate.

As speculation mounts about Biden dropping out of the race, investors are bracing themselves for the potential implications of such an announcement. Some fund managers are already adjusting their portfolios to hedge against the increased risk that a Biden withdrawal could bring.

The Trump Trade and Market Dynamics

The prevailing consensus among traders and strategists is that a re-election of Trump would lead to trades that benefit from a mix of looser fiscal policy and greater protectionism. This includes a strong dollar, higher US bond yields, and gains in sectors like banking, healthcare, and energy.

Market participants around the world are preparing for different trading scenarios in case of a Biden exit. In Sydney, strategists are already strategizing their trades based on the assumption of a Trump victory, as betting markets increasingly favor his re-election.

Implications for Different Asset Classes

The potential ripple effects of a Trump win have already been felt across various asset classes:

– The US dollar could strengthen under Trump’s policies, causing currencies like the Mexican peso and Chinese yuan to weaken.

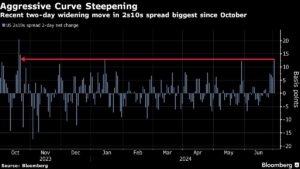

– In the bond market, traders are engaging in steepening trades, buying shorter-maturity notes and selling longer-term ones in anticipation of inflationary pressures.

– Stocks that stand to benefit from a Trump victory, including healthcare, banking, and energy companies, have seen positive momentum in the wake of the debate.

ETF Flows and Crypto Outlook

The exchange-traded fund (ETF) market has shown a clear investing trend, with inflows into financial sector funds in anticipation of Trump-induced deregulation and steeper Treasury curves. Meanwhile, thematic ETFs focused on Republican-friendly stocks have struggled to gain traction.

In the crypto space, Trump’s recent gestures of support for the industry have fueled speculation about the potential benefits of a Trump return to the White House. Assets like the Solana token could see a boost under a Trump administration, with some market participants eyeing potential ETFs that invest in digital currencies.

At Extreme Investor Network, we understand the importance of staying ahead of market trends and making informed investment decisions. As the political landscape continues to evolve, we remain committed to providing our readers with valuable insights and unique perspectives on how to navigate these uncertain times.

Stay tuned for more updates and analysis on the intersection of politics and finance, exclusively on Extreme Investor Network.