Are you ready to capitalize on the soaring success of Nvidia (NASDAQ: NVDA) in 2024? This powerhouse semiconductor company has seen gains of nearly 180% on the stock market, thanks to its impressive performance and strong demand for graphics cards used in AI servers.

While the median 12-month price target for Nvidia sits at $150 according to 64 analysts, indicating a modest 9% upside, Bank of America recently raised their price target to $190, suggesting a potential 38% gain. So, what’s driving this bullish outlook?

Bank of America analysts are enthused by Nvidia’s dominant position in the AI chip market, with projections of capturing 80% to 85% of this lucrative space. With a massive $400 billion market opportunity at stake, Nvidia is poised for substantial growth.

One key factor fuelling Bank of America’s optimism is the introduction of Nvidia’s new Blackwell processors. Backed by a positive earnings report from key supplier TSMC and CEO Jensen Huang’s endorsement of the upcoming Blackwell cards, Nvidia is set to make significant waves in the AI chip market.

The demand for Blackwell chips is expected to surpass supply in 2025, as major players like Amazon Web Services, Dell Technologies, Google, Meta, Microsoft, Tesla, and more are lining up to deploy these cutting-edge processors. The performance leap offered by Blackwell chips, with promises of 4 times better AI training performance and 30 times improved AI inference compared to previous models, has industry giants excited.

Looking ahead, Nvidia’s Blackwell platform is projected to maintain its technological lead, solidifying the company’s share of the AI chip market. Bank of America forecasts that the AI accelerator market could swell to $280 billion by 2027, potentially exceeding $400 billion in the long run.

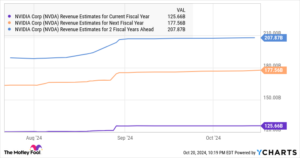

With Nvidia’s revenue from AI accelerators expected to reach $84 billion by the end of fiscal 2025, the company could see substantial growth in the coming years. By controlling a significant portion of the AI accelerator market by 2027, Nvidia could generate $210 billion in revenue, showcasing the company’s immense growth potential.

These prospects have analysts predicting a remarkable 57% annual increase in Nvidia’s bottom line over the next five years. This solid earnings growth could propel Nvidia’s stock higher, making it an attractive investment opportunity.

For investors considering adding an AI stock to their portfolios, Nvidia stands out as a compelling choice. Trading at a reasonable 35 times forward earnings, Nvidia presents an appealing option, especially when compared to the Nasdaq-100 index’s forward-earnings multiple of 30.

Don’t miss out on the chance to ride the wave of Nvidia’s success. Dive into the world of high-flying semiconductor stocks and position yourself for potential gains by exploring the opportunities that Nvidia has to offer.