As we enter the final months of the year, the US inflation rate seems to have plateaued, indicating the ongoing struggle to reach the Federal Reserve’s target. The core consumer price index, excluding food and energy, is expected to show little to no change compared to the previous month. Experts predict that overall consumer prices probably increased by 0.2% for the fourth consecutive month, with a slight uptick in the year-over-year measure.

At Extreme Investor Network, we understand the importance of staying informed about economic indicators like inflation rates. The slow unwinding of pandemic-era price distortions has made reaching the target inflation rate a challenging task. For example, the demand for cars and auto parts following hurricanes has led to an increase in prices for core goods. Additionally, the recent storms have impacted services prices, contributing to a gradual slowdown.

Looking ahead, the US government is set to release wholesale inflation figures, while retail sales data is expected to show continued growth thanks to earnings that outpace inflation. Fed officials will be speaking at various events throughout the week, providing insights into the current economic landscape.

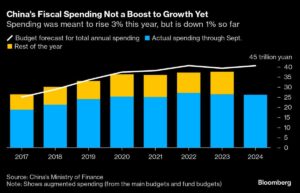

In Canada, the housing market will be closely watched to see if recent rate cuts have had an impact, while other countries like China, the UK, and Australia will release a range of economic data. This includes updates on industrial output, wage statistics, and inflation figures.

As we navigate through uncertain economic times, it’s essential to stay informed about global economic trends and how they may impact investment decisions. At Extreme Investor Network, we strive to provide unique insights and analysis to help our readers make informed financial decisions. Stay tuned for the latest updates on the global economy and investment opportunities.