Market Recovery Attempts Following Major Setback

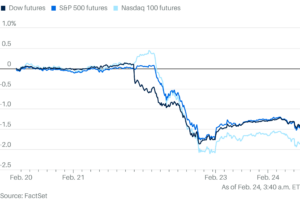

In an optimistic turn of events, U.S. stock futures experienced a notable uptick early Monday, signaling a potential recovery from the previous week’s dramatic downturn. The S&P 500, which recently suffered its most challenging day of the year on Friday, is now seeing futures climb by 0.6%. Similarly, futures for the Dow Jones Industrial Average have risen by 0.7%, and the Nasdaq 100 is up by 0.5%. This rebound comes in the wake of a challenging Friday, where both the S&P 500 and Dow faced losses of 1.7%, marking a significant hit as unsettling economic data sent shockwaves through the markets. The tech-heavy Nasdaq Composite was not spared, enduring a considerable 2.2% slump.

A key driver behind this bearish sentiment was Walmart’s disappointing outlook, released Thursday, which ignited fears regarding the resilience of the U.S. consumer. This anxiety was later compounded by economic indicators released on Friday. The University of Michigan’s consumer sentiment index revealed a concerning drop to 64.7 for February, a stark decline from the 74 reading recorded in December. This shift suggests that consumer confidence is wavering, raising questions about purchasing power and overall economic health.

Additionally, disappointing reports on manufacturing and service activity from S&P Global further fueled investors’ apprehensions. As we navigate these turbulent market waters, it’s critical to stay informed and agile.

Strategic Insights for Investors:

-

Watch Consumer Sentiment: Consumer confidence plays a pivotal role in driving market performance. A sustained decrease could indicate potential downturns in spending, influencing corporate earnings and further market volatility.

-

Sector Performance Variability: With sectors responding differently to economic signals, consider diversifying your portfolio. Defensive stocks, particularly in consumer staples or utilities, may offer stability amid economic uncertainty.

-

Evaluate Economic Indicators: Always keep an eye on key economic reports. Upcoming releases, such as unemployment data and inflation rates, could dramatically shape market outlooks. Understanding these indicators allows for more informed investment decisions.

- Stay Updated with the Market Trends: Regularly monitoring futures can provide insights into morning market sentiments. Early indicators often set the tone for trading sessions.

The financial landscape is complex, and while the uptick in futures offers a glimmer of hope, the potential for further volatility looms overhead. Stay proactive, informed, and ready to adapt to whatever the markets may throw your way. Analysis from trusted financial platforms, such as Extreme Investor Network, can provide you with the tools and insights necessary to navigate these uncertainties effectively.