Navigating the New Economic Landscape: The Challenges of Rising Debt

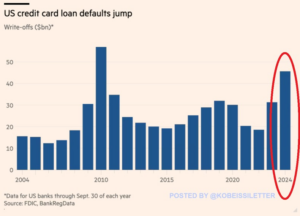

As the economic realities of 2024 unfold, many Americans are grappling with an alarming surge in credit card defaults, which have soared by a staggering 50% over the past year. With credit card defaults reaching $46 billion in the first nine months of 2024 alone, we’re witnessing levels reminiscent of the post-recession era in 2010. The increased cost of living has overwhelmed countless households, leading to dire financial distress.

A Record High in Household Debt

According to the New York Federal Reserve, credit card debt has surpassed $1.17 trillion, marking a historic high as of September 2024. This dramatic rise is part of a larger trend: total household debt has escalated to an eye-watering $17.94 trillion. This encompassing figure includes $12.59 trillion in mortgages, $1.64 trillion in auto loans, and $1.61 trillion in student debt. Alarmingly, household debt has been climbing for ten consecutive years, leaving many families struggling under the weight of financial obligations that seem increasingly unmanageable.

As we take a closer look, the average annual percentage rate (APR) on credit cards as of December 2024 now stands at a staggering 24.43%. The rise of “buy now, pay later” services may seem like a lifeline, but they often lead consumers into deeper financial waters, breeding an escalating spiral of debt as households try to pay off one bill with another.

The Proposed Solution: Interest Rate Caps

In a recent rally, former President Donald Trump proposed capping credit card interest rates at 10%—a halt to the extortionate fees many Americans face. While this suggestion aims to address the escalating crisis of consumer debt, many banks are already pushing back, citing fears that such measures would lead to tighter lending practices. Here at Extreme Investor Network, we understand that while banks may be reluctant to lend under tighter regulations, the need for responsible financial practices has never been more pressing.

The last decade has taught us a critical lesson: living beyond our means is a dangerous game. Consumer habits and fiscal responsibility are being re-evaluated in light of a shifting economic landscape. With the recent shifts in policies and financial dynamics, it’s essential to reassess our financial strategies, ensuring we align with a sustainable living model.

The Burden on Everyday Americans

As inflation continues to grip the nation, many households have resorted to relying on credit to cover basic necessities. The dramatic rise in prices for essentials like energy, food, and housing has forced many upon a precarious financial cliff. Trump’s proposed temporary cap on credit card interest rates underscores a growing recognition of the crippling effect that unchecked interest can have on American families, pushing them further into debt.

Despite the potential benefits of such caps, the dialogue surrounding consumer debt solutions often feels stagnant. Stimulus measures that should stimulate growth have often been misallocated, leading to minimal relief for struggling households. Moreover, the reality is that banks will still profit under lower interest terms, albeit at more reasonable levels.

The Call to Action

The rising tide of debt is an urgent crisis that cannot be ignored. At Extreme Investor Network, we advocate for strategies that emphasize financial literacy, responsible spending, and the importance of saving—values that have been core to America’s economic fabric. As the government, banks, and the public engage in discussions, it’s crucial for comprehensive, consumer-friendly solutions to emerge.

We face an unprecedented opportunity to advocate for better financial practices and to push for fundamental changes that can alleviate the financial burden on families. The goal must be to ensure every American has access to a decent quality of life—one where they can work, live, and save without being weighed down by suffocating debt.

Let us work together to reshape our financial landscape. With information and strategies tailored to the modern investor, Extreme Investor Network is dedicated to empowering you to take control of your financial future. Join us as we navigate this challenging environment and strive for a brighter tomorrow.