The Future of Student Loan Relief: What It Means for Borrowers

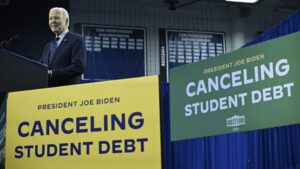

In a recent ruling that has left many borrowers reeling, the 8th U.S. Circuit Court of Appeals blocked President Joe Biden’s student loan relief initiative, known as SAVE (Saving on a Valuable Education). This decision, backed by seven Republican-led states, may significantly impact millions of Americans struggling under the weight of student debt. At Extreme Investor Network, we understand the urgency and complexity surrounding this issue, as it affects not just your finances, but also your aspirations for homeownership, entrepreneurship, and family planning.

Understanding the SAVE Plan and Its Implications

The SAVE initiative was designed to ease the burden on student loan borrowers by reducing monthly payments and accelerating debt forgiveness for those with smaller balances. With federal student loan payments already a significant part of many families’ budgets, the prospect of increasing monthly payments (possibly by nearly $200) is distressing. A recent analysis by the University of Pennsylvania’s Penn Wharton Budget Model suggested the program could cost around $475 billion over the next decade, a figure that incited criticism from fiscal conservatives who argue that taxpayer funds should not subsidize higher education costs.

While the appeal ruling places immense strain on borrowers, it also highlights the broader conversation about the affordability of higher education in America. After all, studies show that student loan debt can stifle key life decisions—like starting a business, buying a home, or even starting a family.

The Bigger Picture: Rising Costs and Future of College Financing

At Extreme Investor Network, we believe it’s essential to look beyond the court’s ruling and consider the overarching financial landscape. College tuition has skyrocketed in recent years, leaving most families with no choice but to rely on loans to cover education costs. The implications of rising educational expenses extend beyond mere loan repayments; they can hinder long-term financial growth and upward mobility.

Exploring Alternative Solutions

Instead of merely reacting to policy changes, it’s time for borrowers to explore alternative solutions for managing their student debt. Here are some strategies that could be helpful:

-

Refinancing Options: Depending on your credit score and financial situation, refinancing could lower your interest rates. Shop around for the best terms, as different lenders offer varying rates.

-

Income-Driven Repayment Plans: Explore the different income-driven repayment options available through federal programs. These plans can significantly reduce your monthly payments based on your income and family size.

-

Employer Repayment Assistance Programs: Some employers now offer student loan repayment assistance as part of their benefits package. Don’t hesitate to ask your HR department about available options.

-

Budgeting for Repayment: Creating a comprehensive budget that prioritizes loan repayments can help you stay on top of your finances and avoid financial setbacks. Consider automating payments to make the process easier.

- Advocacy and Awareness: Stay informed about legislative changes and advocate for policies that support affordable education and loan repayment options. Engaging with community groups or online forums can help amplify the voices of those affected by student debt.

Final Thoughts

The recent ruling against the SAVE plan serves as a stark reminder of the ongoing challenges faced by student loan borrowers. At Extreme Investor Network, we are committed to empowering our readers with the knowledge and tools necessary to navigate this complex landscape. By exploring alternative financial strategies and staying informed about policy changes, you can take charge of your financial future despite the obstacles thrown your way. Remember, while the situation may seem daunting, proactive planning and informed decision-making can pave the way for a brighter financial outlook.

Let’s be a part of the conversation and work together to find solutions that promote financial stability and success for all borrowers.