Tesla’s Market Position and Competition: A Closer Look

Tesla (NASDAQ: TSLA), currently ranked as the eighth-largest company globally, boasts a market capitalization exceeding $1.05 trillion. However, its journey through 2024 has been far from smooth. The stock underperformed compared to the S&P 500 for most of the year, yet it recently saw a significant boost—jumping nearly 50% in just one month. The catalyst? Speculations surrounding the U.S. elections and the perceived positive influence of CEO Elon Musk’s relationship with President-Elect Donald Trump may be advantageous for Tesla’s future.

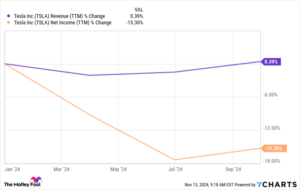

Recent Performance Indicators

Nonetheless, investors should proceed with caution as Tesla’s recent financial outcomes haven’t painted an optimistic picture. The anticipated earnings growth is projected at a meager 4% annually over the next five years. Such forecasts suggest a challenging environment ahead for Tesla, which has been grappling with increased competition in the electric vehicle (EV) market and delivering underwhelming presentations, such as the launch of the Cybercab.

The Competition: TSMC and Broadcom

As Tesla faces these hurdles, two semiconductor giants—Taiwan Semiconductor Manufacturing (NYSE: TSM) and Broadcom (NASDAQ: AVGO)—are poised to capitalize on their robust trajectories and could soon surpass Tesla in market cap.

TSMC is currently ranked the 10th largest company with a market cap of approximately $995 billion. With a commanding 62% market share in the semiconductor foundry sector, according to Counterpoint Research, TSMC leads its competition by a substantial margin, outpacing Samsung’s 13%. This strong position enables TSMC to ride the wave of escalating demand for semiconductors driven by the growth of AI applications across diverse sectors, including smartphones, personal computers, and data centers.

Major players in the tech industry, such as Nvidia, Apple, AMD, and Qualcomm, rely heavily on TSMC for chip manufacturing. Notably, TSMC’s revenue surged by 31% year-over-year in the first ten months of 2024. With a revenue forecast projecting a remarkable 30% growth to $90 billion for the full year—following a 9% decline in the prior year—TSMC is positioned for sustained growth. Analysts anticipate a staggering 26% annual increase in earnings over the next five years, all while trading at a reasonable price-to-earnings (P/E) ratio of 34—significantly lower than Tesla’s 90.

Broadcom’s Strong Growth Potential

Similarly, Broadcom is tapping into the burgeoning demand for AI chips. Known for its application-specific integrated circuits (ASICs), Broadcom stands as the second most significant player in the AI chip market, following Nvidia. In its fiscal Q3 of 2024, Broadcom reported a remarkable 3.5-fold increase in sales of custom AI chips compared to the previous year. With an estimated market share of 55% to 60% in this segment, Broadcom has substantial revenue opportunities—potentially worth between $20 billion to $30 billion—growing at an annual rate of 20%.

This growth aligns with the shift toward AI-enhanced data centers, as evidenced by Broadcom’s networking revenue soaring by 43% year-over-year in fiscal Q3. Given that Broadcom’s market cap rests at $813 billion, it sits just 27% behind Tesla, with analysts forecasting that its earnings will rise by 20% each year for the next five years—mirroring TSMC’s anticipated performance and outpacing Tesla’s growth rate.

The Bottom Line

The outlook for TSMC and Broadcom as potential market cap leaders could reshape the tech landscape as they harness the surging demand for semiconductor chips driven by technological advancements, particularly in AI. Investors should keep a watchful eye on how these companies evolve in the coming months; the competition is intensifying, and as Tesla navigates a challenging market, the ascent of TSMC and Broadcom could redefine industry rankings.

At Extreme Investor Network, we emphasize the importance of staying informed about shifting market dynamics and emerging opportunities. As stock performance continues to fluctuate, being part of our community means you won’t miss out on critical analysis and insights that could help steer your investment decisions.