The Power Play: Ukraine’s Mineral Deal and U.S. Strategic Interests

In a pivotal moment for both geopolitics and global economics, a recent mineral deal has catalyzed a shift in U.S. foreign policy towards Ukraine. This agreement not only marks the first sale of military equipment to Ukraine during President Trump’s administration but also underscores the intricate relationship between mineral resources and national defense.

A Bold Move by the Trump Administration

Despite his previous criticisms of Ukrainian President Volodymyr Zelensky, President Trump’s willingness to approve a $50 million defense package reflects the changing dynamics in international relations. This package, facilitated through Direct Commercial Sales (DCS), was contingent upon a significant mineral extraction deal, showcasing Trump’s business-minded approach to foreign policy.

The Mineral Deal: A Dual Advantage

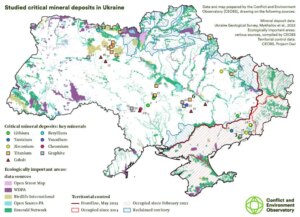

At the heart of this agreement lies a strategic advantage for the United States: preferential rights to extract critical minerals from Ukraine. With China currently monopolizing about 75% of the world’s rare earth minerals, this deal offers the U.S. an opportunity to diversify its sources and reduce dependence on a single nation. Rare earth elements, crucial for advancing technologies and defense systems, are more than just commodities; they are the building blocks of a competitive edge in the global market.

Commitment to Ukrainian Sovereignty

Importantly, Ukraine retains full ownership of its natural resources, needing to approve any extraction efforts. This stipulation aims to ensure that while the U.S. benefits, Ukraine is not stripped of its invaluable assets. The formation of a joint Reconstruction Investment Fund illustrates a commitment to shared success. According to Ukraine’s Economy Minister, Yulia Svyrydenko, 50% of revenue from licenses will funnel into this fund, encouraging Western investment to aid Ukraine’s recovery.

This partnership is not merely transactional; it’s a collaborative effort to stabilize and revitalize the Ukrainian economy. Svyrydenko envisions a broader role for U.S. investments, stating, “Together with the United States, we will create a fund that will attract Western investments to our country.”

Prospects for Economic Recovery

As reported by the U.S. Treasury Department, this economic partnership opens doors for collaborative investment, allowing both nations to leverage their strengths. The first decade of profits from mineral extraction will be reinvested back into Ukraine, reinforcing the commitment to long-term economic stability amidst ongoing conflict.

Global Reactions: A Mixed Bag

While the United States views this deal as a pathway to mutual economic growth, reactions from the Kremlin have been predictably critical. Russian officials express concerns that the deal symbolizes U.S. exploitation of Ukraine, reducing the nation to a mere resource provider amid a protracted war. Deputy Chairman of Russia’s Security Council, Dmitry Medvedev, has condemned the agreement, labeling it a strategic maneuver to leverage Ukraine’s resources for U.S. gain.

Looking Ahead: The Future of the U.S.-Ukraine Relationship

As we navigate through these complex global dynamics, questions linger about the implications of this mineral deal. Will it lead to deeper U.S. military involvement in Ukraine, or can it be a catalyst for diplomatic resolutions? The situation remains fluid, and investors should closely monitor developments—particularly as global tensions and resource conflicts continue to escalate.

Conclusion

The Ukraine mineral deal stands as a testament to the interplay between economics and geopolitics. For those invested in understanding these dynamics, the Extreme Investor Network provides unparalleled insights into the evolving landscape of international trade, resource allocation, and investment strategies. Join us as we explore the implications of these developments and how they will shape the future of global economics.

Stay informed, stay strategic, and invest wisely. The world is watching, and so should you.