Bracing for Market Volatility: Insights from Steve Diggle’s New Hedge Fund Strategy

In a climate reminiscent of the pre-2008 financial crisis, former hedge fund manager Steve Diggle is gearing up for what could be a turbulent period in the markets. With his firm, Vulpes Investment Management, seeking to raise up to $250 million in investments, Diggle highlights risk factors that could lead to significant market disruption. His insights and strategies serve as a critical reminder for investors to reassess their positions and consider proactive hedging strategies.

Uncovering Opportunities Amid Risk

Diggle’s past demonstrates a knack for navigating market peril. His previous firm, Artradis Fund Management, famously generated $3 billion in profits during the tumultuous period between 2007 and 2008. This formidable track record has led him to develop a hedge fund designed specifically for capitalizing on volatility—whether it emerges during market crashes or quieter times.

At the core of Vulpes’s strategy is a distinctive approach to risk assessment, employing artificial intelligence to sift through vast amounts of public data. This method not only helps identify potential pitfalls in Asia-Pacific companies, such as high leverage or potential fraud but also allows for bullish investments in certain equities and indices. The keen analytical edge afforded by AI underscores the need for investors to modernize their strategies and leverage technology for better decision-making.

The Current Landscape: A Market Paradox?

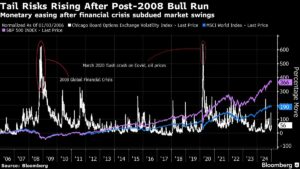

Diggle points out that many risk indicators today are alarmingly similar to those preceding the last financial crisis. With U.S. stock valuations stretched thin and a potential surplus in the commercial real estate market, the current ecosystem exhibits a unique blend of risk factors. Central to this risk are escalating geopolitical tensions and lingering issues within China’s shadow banking system.

The evolution of market dynamics, especially the influence of algorithmic trading and retail investors, is also noteworthy. A new cohort of traders, shaped by a prolonged bull market, are pushing certain tech stocks and cryptocurrencies to unprecedented heights. According to Diggle, this could create further market vulnerabilities, suggesting that now might be the time to reassess and recalibrate investment strategies, particularly in the face of ongoing economic uncertainty.

Strategic Adaptations: From Passive to Proactive

Interestingly, while speculative “volatility-only” strategies often flounder during calmer market periods, Diggle’s approach avoids this pitfall. By incorporating a diversified strategy that leverages both risk mitigation and growth opportunities, Vulpes seeks to create a balanced portfolio that can thrive in various market conditions. This nuanced perspective is critical for investors looking to withstand market shocks without sacrificing potential upside.

With rising options prices making hedges more accessible, now may be an opportune moment for investors to reconsider their protective measures. Diggle emphasizes that the current market dynamics require a renewed focus on hedging strategies, suggesting that everyone from individual investors to large institutions should rethink their risk management tactics.

Leadership in Uncertainty

While he will not be returning to daily trading—leaving that to Singapore-based Robert Evans, an experienced portfolio manager—Diggle’s overarching vision positions him as a guiding force in Vulpes’s strategic direction. His ability to identify fault lines in the market reinforces the importance of foresight and adaptability in investment management.

As we look ahead, it is clear that market volatility is not just a potential outcome but a critical dimension of investment strategy. With an ever-evolving landscape characterized by uncertainty and change, the key takeaway from Diggle’s renewed focus on volatility is a clarion call for proactive engagement with risk.

Summing Up

Now is the time for investors to think critically about their portfolios, especially in light of the myriad risks evident in today’s market environment. The strategies outlined by Steve Diggle and his family office serve as valuable lessons for investors aiming to navigate the complexities of modern finance. At Extreme Investor Network, we encourage our readers to stay informed, adapt their strategies, and embrace the tools at their disposal to thrive in uncertain markets. Remember, the future belongs to those prepared to meet it head-on, armed with insight and a clear plan.