The first half of the year is behind us, offering a snapshot of the hopes and risks ahead. The stock market has shown strong gains, with the S&P 500 up nearly 17% and the NASDAQ up 24%. However, these gains are narrow and concentrated in the tech sector, particularly with companies like Nvidia leading the pack.

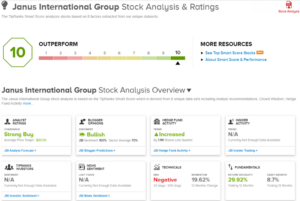

As we navigate through an election year, uncertainty looms large. However, with the right tools, such as the Smart Score from TipRanks, investors can filter out the noise and focus on promising opportunities. This AI-based data algorithm rates stocks based on various factors to provide a simple score, highlighting top-performing stocks worth a closer look.

Let’s delve into two top-scoring stocks – ‘Perfect 10s’ – that have caught the attention of analysts and are projected for significant growth.

Janus International Group (JBI)

Janus International Group is a construction-focused company that specializes in providing innovative door solutions for various sectors. From self-storage facilities to commercial buildings, Janus offers a range of high-tech doors designed to enhance security and functionality. The company’s recent acquisition of Terminal Maintenance and Construction demonstrates its commitment to expanding its business footprint and offering comprehensive facility maintenance services.

With solid financial performance in the first quarter and positive analyst sentiment, Janus is positioned for continued growth. Jefferies analyst Philip Ng sees significant potential for the stock, giving it a Buy rating with a price target indicating a 63% upside on a one-year horizon.

Atmus Filtration Technologies (ATMU)

Atmus Filtration Technologies is an industrial firm specializing in filtration solutions for a wide range of industries globally. As an independent entity with a strong market presence and robust intellectual property portfolio, Atmus is poised for growth. With a recent report showing strong revenue and earnings, the company’s macro-resilient business model and growth prospects make it an attractive investment opportunity.

Analyst Bobby Brooks from Northland gives Atmus a positive outlook, with an Outperform (Buy) rating and a price target suggesting a 26% upside potential. With all recent analyst reviews pointing towards a Strong Buy consensus, Atmus presents a compelling investment case for investors.

To discover more promising stocks with attractive valuations, check out TipRanks’ Best Stocks to Buy tool. Remember, it’s essential to conduct your own analysis before making any investment decisions.

At Extreme Investor Network, we believe in providing valuable insights into the world of finance and investment opportunities. Stay tuned for more expert analysis and recommendations to help you navigate the dynamic financial landscape with confidence and success.