At Extreme Investor Network, we believe in providing you with the latest insights and updates on the finance world to help you make informed investment decisions. Today, we want to highlight some of the key companies making headlines before the bell.

1. GameStop: Shares of the video game retailer dropped more than 20% after announcing plans to sell 45 million common shares of its stock. Additionally, preliminary results showed a sales decline in the first quarter. This decision can have a significant impact on the company’s future performance and investor sentiment.

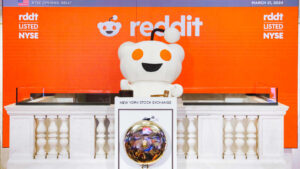

2. Reddit: The social media company rallied 10.5% after announcing a partnership with OpenAI. This collaboration will bring new artificial intelligence features to Reddit, enhancing user experience and engagement. Investors should keep an eye on how this partnership unfolds and its potential implications for both companies.

3. Take-Two Interactive Software: Shares of the video game company were down more than 2% following an update on the timing of the new Grand Theft Auto game. With the game now set to release in the fall of 2025, investors will need to reassess their expectations and projections for Take-Two Interactive Software.

4. Snowflake: The cloud computing company’s stock edged lower after reports of discussions to acquire startup Reka AI for more than $1 billion. Mergers and acquisitions can significantly impact a company’s growth trajectory and market position, so investors should closely monitor any developments in this potential deal.

5. Doximity: Shares of the online networking company surged nearly 18% after beating fourth-quarter estimates on both the top and bottom lines. With strong financial performance and in-line revenue guidance for the first quarter, Doximity continues to demonstrate its growth potential in the digital networking space.

6. Globant SA: The IT company’s stock dropped more than 3% after issuing second-quarter earnings and revenue guidance that fell short of estimates. As investors react to this news, it’s essential to evaluate the factors driving Globant SA’s performance and assess its long-term growth prospects in the technology sector.

At Extreme Investor Network, we aim to empower investors with valuable insights and analysis to navigate the dynamic world of finance. Stay tuned for more updates and expert commentary on the latest market trends and investment opportunities. Remember, knowledge is power in the world of investing.