Sweetgreen, Reddit, and IonQ: Spotlight on Stocks That Shone in 2024

In the fast-paced world of finance, stock performance isn’t just a number—it’s a narrative. As we dive into Sweetgreen (NYSE: SG), Reddit (NYSE: RDDT), and IonQ (NYSE: IONQ), it’s clear that 2024 was a transformative year for these companies. Let’s explore what drove their impressive rebounds and what investors should keep in mind for 2025.

The Sweetgreen Comeback

Once viewed as a salad stock with a lackluster following, Sweetgreen started 2024 down a staggering 80% from its IPO pricing in 2021. Yet by November, its shares had more than tripled, capturing the attention of discerning investors. The catalyst? The introduction of the Infinite Kitchen model, which emphasizes automation in food preparation.

This initiative aims to significantly reduce labor costs—Sweetgreen allocated 28% of its revenue to labor and related expenses through the first three quarters of 2024. The potential of robotics to streamline the preparation process presents an exciting opportunity for enhancing profitability. In fact, by the end of Q3 2024, the company had increased the number of outlets utilizing this technology from 2 to 10 across its 225 locations. As Sweetgreen scales up this model in 2025, its operational efficiency could improve dramatically, and with it, its bottom line.

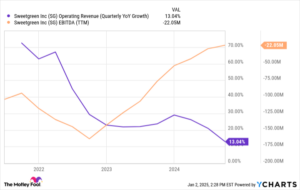

Moreover, while the company is slowing the pace of new restaurant openings to focus on profitability, its earnings before interest, taxes, depreciation, and amortization (EBITDA) continue to climb. With the Infinite Kitchen in its infancy and operational metrics improving, Sweetgreen may well be the stock to watch in 2025.

Reddit’s Rapid Ascent

The social media platform Reddit has also demonstrated remarkable growth, with its stock soaring by 224% in the second half of 2024, an impressive feat given its IPO was just in March. What’s behind this surge? A blend of accelerated top-line growth and user engagement.

In Q3 2024, Reddit’s revenue grew by a robust 68% year-over-year, reaching $348 million, fueled by a rising advertiser demand and an expanding user base. Furthermore, the company is making a strategic push into international markets, utilizing artificial intelligence to translate content into various languages. Currently holding around 49 million users outside the U.S., Reddit’s growth potential remains largely untapped.

As Reddit continues to capture advertising demand and improve its gross margins—now exceeding 90%—its free cash flow is surging. This growth trajectory positions Reddit as a strong player, particularly as it scales its user base in international markets where potential remains vast.

IonQ: The Quantum Computing Powerhouse

No discussion about growth stocks would be complete without mentioning IonQ. This quantum computing entity also saw its stock triple in value in 2024, defying skepticism around its industry. While confidence in the broader quantum space fluctuates, IonQ has secured significant contracts, including a $55 million deal with the Air Force Research Lab to explore scalable quantum computing applications. Such endorsements lend critical third-party validation to IonQ’s technology.

With its trapped ion approach to quantum computing, IonQ’s products are now accessible on all major cloud computing platforms, which is a substantial advantage in the emerging quantum economy. Analysts foresee the quantum sector reaching hundreds of billions in value, and with IonQ poised at the forefront, it offers intriguing long-term potential for investors.

Our Top Pick for 2025

As the landscape looks toward 2025, each of these stocks has its arguments for future investment. While Reddit and IonQ possess undeniable momentum with their strong growth numbers, I believe Sweetgreen might offer the most compelling risk-reward scenario right now. Trading at 5 times sales, Sweetgreen is not without its valuation challenges, yet the pivot toward improved profitability through automation places it in a unique position. Should its Infinite Kitchen model prove successful, the prospects for both earnings growth and expansion into new markets could be significant.

Sweetgreen aims for an ambitious target of 1,000 locations from its current base of fewer than 250. With a renewed focus on profitability and advancements in technology, it may be on the brink of scaling its operations effectively.

Final Thoughts

Investors should approach all stocks discussed here with due diligence. While Sweetgreen is my top pick for 2025, it’s essential to consider the competitive landscape and industry trends across all three stocks. Whether you’re scouting for growth, evaluating valuation, or scrutinizing market trends, Extreme Investor Network will keep you informed and empowered in your investment journey. Stay tuned for more insights as we head into the new year!