Market Update: Post-Election Rally Hits a Speed Bump

The stock market’s euphoric rally following the recent election has encountered a significant downturn. During the past week, the S&P 500 (^GSPC) dropped more than 2%, while the Dow Jones Industrial Average (^DJI) shed over 500 points—a decline of approximately 1.3%. The tech-laden Nasdaq Composite (^IXIC) experienced an even steeper drop of over 3%.

So, what triggered this market correction? A couple of stark inflation reports and statements from Federal Reserve Chair Jerome Powell have added to investor uncertainty. Concerns about the potential trajectory of interest rates have overshadowed earlier optimism regarding anticipated policy changes under Trump’s administration.

As we look ahead, a series of economic reports due for release this week may provide more clarity. Data on activity in both the services and manufacturing sectors, alongside consumer sentiment readings, will be particularly noteworthy.

Earnings Season: Spotlight on Major Players

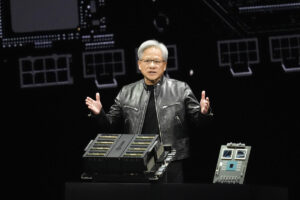

Despite the macroeconomic turmoil, corporate earnings are poised to pull some attention back to individual stocks. Notable reports include those from AI powerhouse Nvidia (NVDA), scheduled to release its results after the market closes on Wednesday. Other major retailers like Walmart (WMT), Target (TGT), BJ’s (BJ), and Deere & Company (DE) will also be under the microscope this earnings season.

The bond market has been quite volatile of late, especially after the Federal Reserve cut its benchmark interest rate by 50 basis points on September 18. Since then, we’ve witnessed a sharp increase in bond yields, with the 10-year Treasury (^TNX) yield rising roughly 80 basis points, recently approaching 4.5%. While initially fuelled by optimism surrounding economic growth, these rising rates have started to challenge the equity market.

Recent inflation insights muddy the waters for optimistic forecasts regarding future rate hikes. The core Consumer Price Index (CPI) displayed a steady 3.3% increase for the third consecutive month, while the core Producer Price Index (PPI) revealed a jump to 3.1%, significantly above pre-release estimates.

The Fed’s Stance: No Quick Rate Cuts

In a recent speech, Powell indicated there’s no urgency to reduce interest rates given the underlying strength of the U.S. economy. This perspective sent markets tumbling, with the Nasdaq Composite experiencing a loss of over 2.2% on Friday alone. Analysts predict the Fed may reassess its easing strategy as inflation data continues to trend in a less favourable direction, according to a note from Wells Fargo’s economics team.

As of Friday, market sentiment reflected a 58% likelihood of a 25-basis-point cut to interest rates at the upcoming December meeting, a drop from the near 86% chance observed a month ago according to the CME FedWatch Tool. Omar Aguilar, CEO of Schwab Asset Management, highlighted that these macroeconomic uncertainties could prompt investors to consider taking some profits off the table.

Earnings Growth Against a Volatile Backdrop

Despite the tumult in the broader market, earnings for S&P 500 companies have remained robust, with reporting reflecting a 5.4% year-over-year increase—the fifth consecutive quarter of growth. Nvidia is a critical player in this narrative, with analyst expectations pushing for significant results. The consensus forecast is pegged at earnings per share of $0.74 on revenues of $33.21 billion, showing over 80% growth annually.

As Nvidia continues to ride the wave of AI demand—boosted by its latest Blackwell chip launch—its earnings report is anticipated to be a key driver for market sentiment. Historically, Nvidia’s performance has been seen as a bellwether for tech stocks, although its impact on the broader market has been inconsistent. For instance, Nvidia’s last earnings update led to a 6% drop in share prices, yet the S&P 500 remained largely unaffected that day.

Navigating the Small-Cap Blues

In the wake of recent market adjustments, small-cap stocks have also faced their share of challenges. The Russell 2000 (^RUT), which initially surged over 9% after Trump’s election, has surrendered half of those gains. Analyst Michael Kantrowitz expressed concerns over dwindling earnings momentum among small-cap firms, underlining the importance of accelerating earnings to indicate a robust recovery.

Citi’s U.S. equity strategist Scott Chronert emphasized the ongoing policy uncertainty and lack of clarity regarding key economic positions under the new administration. Such factors could explain the recent sell-offs despite earlier euphoric sentiment levels.

Upcoming Data to Watch

Investors should keep an eye on a slew of upcoming economic data and earnings reports:

-

Next Week’s Key Economic Indicators:

- NAHB Housing Market Index (November)

- Housing Starts (October) and Building Permits (October)

- MBA Mortgage Applications

- Jobless Claims (week ending Nov. 16)

- Earnings Reports of Interest:

- Lowe’s (LOW)

- Nvidia (NVDA)

- Target (TGT)

- Baidu (BIDU)

- Deere & Company (DE)

With the convergence of significant earnings reports and economic updates, the coming week promises to keep investors on their toes as they navigate the evolving financial landscape.

Stay tuned to Extreme Investor Network for the latest insights and analyses that matter to your investment strategy!