Inflation Rates Dip Slightly as Fed Focuses on Labor Market

US inflation is expected to have slowed down at the end of the third quarter, giving some relief to the Federal Reserve as it shifts focus towards supporting the labor market. The consumer price index is projected to have risen by only 0.1% in September, marking its smallest increase in three months. Compared to the previous year, the CPI is expected to have gone up by 2.3%, which is the tamest growth since early 2021.

The core inflation rate, excluding food and energy prices, is anticipated to have increased by 0.2% from the previous month and 3.2% from the same time last year. This more stable measure of inflation provides a better view of the underlying trends.

These modest inflation rates may lead policymakers to opt for a smaller interest rate cut when they meet in early November. Fed Chair Jerome Powell has indicated that the current projections point towards quarter-point rate cuts at the final two meetings of the year.

The CPI and producer price index are essential indicators used by the Fed to track inflation trends and inform their preferred inflation measure, the personal consumer expenditures price index.

Bloomberg Economics analysts expect that overall, the report will reaffirm the Fed’s confidence that inflation is on a sustainable downtrend, despite some fluctuations in specific categories.

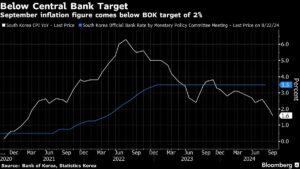

Looking ahead, several key economic events are on the horizon. Central banks in countries like New Zealand and South Korea may decide to cut rates, while the European Central Bank will release minutes from their September policy meeting.

Extreme Investor Network’s Analysis:

At Extreme Investor Network, we delve deep into economic data to provide unique insights for our members. Our team of expert economists closely monitors market trends and forecasts to help you make informed financial decisions. Stay ahead of the curve with our exclusive analysis and be prepared for whatever the market throws your way.

Remember, knowledge is power in the world of finance. Join Extreme Investor Network today to access cutting-edge analysis and stay a step ahead in the financial world.