Rumble’s Meteoric Rise and Tether’s $775 Million Bet: What Investors Need to Know

Shares of Rumble, a dynamic technology company specializing in media streaming, are experiencing a significant surge, currently at 52-week highs as they have climbed roughly 300% since their January lows. A major catalyst for this impressive leap has been a substantial $775 million investment from Tether Limited, the firm behind the world’s leading stablecoin, Tether (USDT). This partnership is not just a financial transaction; it symbolizes growing confidence in the future of decentralized platforms.

Tether’s Role in the Cryptocurrency Landscape

Tether stands as the third-largest cryptocurrency by market capitalization, trailing only Bitcoin and Ethereum. With a market cap nearing $140 billion, Tether differentiates itself as a stablecoin, engineered to maintain a 1-to-1 value with the U.S. dollar, offering investors stability in a notoriously volatile market. This unique structure allows users to engage in the cryptocurrency space without the fear of dramatic swings in value, which is often the case with most cryptocurrencies.

As of the end of September, Tether reported approximately $125 billion in reserves to support its stablecoin, primarily composed of U.S. Treasury bills. This not only ensures liquidity for redemption but also creates potential revenue for Tether through interest. Tether’s CEO, Paolo Ardoino, indicated that the company projects a staggering $10 billion in net profit for 2024—an impressive feat that underscores the financial clout behind this partnership.

Rumble’s Vision and Challenges Ahead

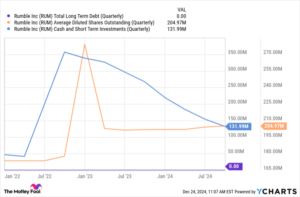

Originally making waves with its IPO in 2022, Rumble aims to establish a decentralized media infrastructure free from censorship—a bold vision that puts it in direct competition with giants like YouTube and Amazon Web Services (AWS). However, such ambitious plans have come with hefty financial implications. Rumble reported a net loss of $116 million in 2023 and has already faced another $102 million loss in the first three quarters of 2024, raising questions about its financial sustainability.

Despite these challenges, Rumble merits acknowledgment for not resorting to shareholder dilution or increasing its debt levels. The company has successfully funded its growth from its own cash reserves rather than relying on external financing. This prudent approach aligns with the expectations of shareholders who have entrusted their capital to help realize Rumble’s long-term objectives.

Opportunities for Growth and Investor Confidence

One of the primary concerns for investors has been Rumble’s cash burn rate, which understandably raised liquidity concerns. However, the substantial cash infusion from Tether has alleviated these worries, allowing Rumble to focus on executing its strategy with greater confidence.

In the third quarter of 2024, Rumble boasted 67 million monthly active users, a substantial number that indicates a solid existing user base despite a slight decline from 71 million in the same period last year. The critical question now is whether Rumble can effectively monetize this audience. The company does offer a premium subscription model, which provides some revenue, but increasing advertising interest remains an ongoing challenge. As CEO Chris Pavlovski aptly pointed out on the Q3 earnings call, “How much longer can brand advertisers ignore more than half the country?”

Conclusion: A Softer Landing for Investors

The positive news for Rumble’s investors is that, thanks to Tether’s investment, the company now has a longer financial runway to execute its plans. In the world of investing, having time to maneuver can often mean the difference between success and failure.

At Extreme Investor Network, we continually monitor opportunities like Rumble and Tether’s innovative strategies. Every investment carries risk, and our commitment is to equip investors with timely insights and expert recommendations. Keeping a close eye on developments in companies like Rumble can lead to exciting investment prospects.

If you’re eager to catch the next wave of high-potential stocks before they explode, sign up for our exclusive alerts. Our expert analysts are currently identifying “Double Down” stock opportunities that could prove to be the game-changers you’ve been waiting for.

Unlocking Potential: Join Us Today!