Investors are eagerly pouring money into corporate bonds, driving risk premiums down and sparking hope that the US will avoid a recession following the Federal Reserve’s interest rate cut. However, some experts warn that the market may be too complacent about underlying concerns.

At Extreme Investor Network, we prioritize providing our readers with unique insights and valuable information to help them navigate the complexities of the finance world. According to Simon Matthews, a senior portfolio manager at Neuberger Berman, factors such as the upcoming US election, sluggish economic growth in Germany, consumer strain, and a slowdown in China suggest that credit spreads may not accurately reflect the current economic climate.

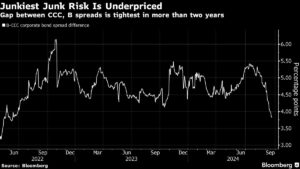

Despite potential risks, investors are venturing into riskier areas of credit in search of higher yields, with even the lowest-rated bonds outperforming the broader junk bond market. The expectation of lower borrowing costs enabling debt-heavy companies to refinance and extend maturities is driving this interest. As interest rates fall, there is a shift towards medium- and longer-term corporate debt from money markets, tightening spreads further.

However, concerns about inflation resurfacing with increased consumer spending post-rate cuts are on the horizon, as highlighted by Hunter Hayes, chief investment officer at Intrepid Capital Management Inc. Furthermore, the potential impact of a weakening labor market on spreads and yields is a cause for caution, as mentioned by JPMorgan Chase & Co. analysts.

Our experts at Extreme Investor Network advise keeping an eye on signs of fundamental deterioration, particularly among borrowers exposed to floating-rate debt. The analysis of BlackRock Inc. researchers highlights the pressure on issuers rated CCC, even amidst recent outperformance. These companies face challenges with low earnings compared to interest payments, which could lead to default risks.

As we continue to monitor the evolving finance landscape, we emphasize the importance of staying informed and making strategic investment decisions. Extreme Investor Network is committed to providing exclusive insights and expert analysis to help our readers navigate the dynamic world of finance.

Stay tuned for more updates and expert insights on finance trends from Extreme Investor Network.

Check out the full article for more in-depth analysis and expert insights.