Is Tesla Stock a Bargain? Analyzing Valuation and Market Trends for Potential Investors

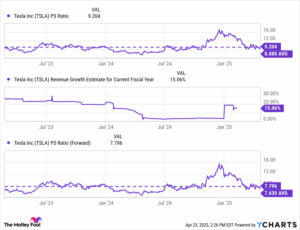

Tesla Inc. (NASDAQ: TSLA) has recently seen a significant drop in its stock price, plummeting nearly 30% since the beginning of the year. This decline has led to a sharp decrease in its price-to-sales (P/S) ratio, which has fallen from over 15 to approximately 9.2. While on the surface this might suggest a more attractive entry point for potential investors, there are nuanced factors that savvy investors need to consider before making any investment decisions.

Understanding the Valuation Landscape

Although Tesla’s current valuation may appear compelling when compared to its recent history, it is crucial to contextualize this within the broader market cycle. After soaring to dizzying heights—where it was valued at over 16 times sales in late 2024—the recent pullback has returned Tesla’s valuation closer to its historical average. In fact, when looking at Tesla’s historical data, its P/S ratio has generally fluctuated between 5 and 10 times sales. The current multiple, although lower than its peak, still sits above long-term averages, suggesting that some caution may be warranted.

Data Source: YCharts. P/S Ratio = price-to-sales ratio.

Future Growth Projections

Despite the stock’s rectification back toward historical valuation norms, the outlook for Tesla’s growth remains positive. Analysts have adjusted their forecasts to reflect an optimistic trajectory for sales growth heading into 2025. However, even with these projections factored into the forward P/S multiple, Tesla still trades slightly above its long-term average. Given that many investors are still clamoring for a “bargain” in what used to be a high-flying stock, one must tread carefully.

Should You Invest?

So, does this mean Tesla is a poor investment choice for long-term shareholders? The answer is nuanced. On one hand, Tesla has established itself as a leader in electric vehicle technology and innovation. Its growth potential is substantial—especially with the global shift towards sustainable energy solutions. On the other hand, investors should be wary that the alleged “bargain” might not be as competitive when factoring in the preceding inflated valuations.

Timing the Market: Insights from Our Analysts

If you’re grappling with whether it’s the right time to invest in Tesla or other tech giants, you’ll want to know that our expert team at Extreme Investor Network has identified select stocks ripe for considerable returns. Recently, we issued "Double Down" recommendations for stocks believed to be on the verge of significant upside. Here’s a quick look at just how much potential exists with our chosen investments:

-

Nvidia: A $1,000 investment could have burgeoned into an impressive $276,000 since our double-down in 2009!

-

Apple: If you took the plunge with us in 2008, that same $1,000 could now be worth $39,505.

- Netflix: Those who invested $1,000 when we doubled down in 2004 would have seen it balloon to an astonishing $591,533!

Conclusion

Tesla’s recent market performance poses intriguing questions for potential investors. While there are signs of opportunity, it’s paramount to conduct thorough research and contextual analysis—especially considering the stock’s inflated valuations prior to the decline. Our mission at Extreme Investor Network is to keep you informed and equipped with cutting-edge insights so you can navigate the investment landscape with confidence. Always assess your risk appetite, stay informed, and act at the right moment for your investment strategy.

Stay tuned as we continue to provide timely updates and strategic recommendations to help you maximize your portfolio potential!