Is Inflation Really Transitory? A Closer Look at Powell’s Predictions and Consumer Spending

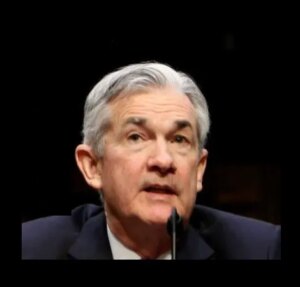

In a recent statement, Federal Reserve Chair Jerome Powell reiterated his stance on inflation, suggesting that it could be considered “transitory” — a term that hearkens back to the Fed’s previous optimistic predictions during the inflationary spike of 2021. While Powell’s confidence is reassuring, history teaches us to approach such claims with caution, particularly as the Fed grapples with growing market skepticism.

Powell has stated, “It can be the case that it’s appropriate sometimes to look through inflation if it’s going to go away quickly, without action by us, if it’s transitory.” He suggested that this outlook could apply in cases of “tariff inflation,” which assumes that price increases fueled by tariffs may dissipate quickly. For Powell’s assertion to hold water, however, it hinges on two critical factors: the swift resolution of such tariff-related inflation and the anchoring of inflation expectations among consumers.

Consumer Spending: The Heart of the Economy

As the Federal Reserve closely monitors inflation data, it’s essential to remember that consumer spending is the backbone of the U.S. economy. Recent statistics from the Department of Commerce indicate that retail sales in February saw a modest increase of 0.2%, following a more significant decline of 1.2% in January. This climb, however, fell short of the projected 0.6% increase, hinting that consumer confidence is wavering.

Data from the last three months show a year-over-year gain of 3.7% in total sales. Yet, the underlying growth remains lethargic. The University of Michigan’s consumer sentiment survey showed a sharp 10% drop in consumer confidence from February to March, highlighting an atmosphere rife with uncertainty.

Matthew Shay, President and CEO of the National Retail Federation, emphasized that “February sales had slowed as a direct result of tariff threats.” He noted that consumer spending has taken a slight hit due to various factors, including harsh winter weather, rising unemployment, and an overarching air of policy uncertainty. Consumers are becoming more cautious, choosing to save rather than spend amid rising prices for essential goods.

The Impact of Retail on Employment and the Economy

The retail sector, integral to the health of the American economy, is the country’s largest employer, contributing a staggering $5.3 trillion to the annual GDP. Currently, one in four Americans—approximately 55 million individuals—are employed in this vital sector. The restrictions and uncertainties arising from external factors, such as tariff disputes, create a ripple effect that not only affects consumer behavior but also job security within retail.

As household budgets tighten due to escalating living costs, consumers are confronted with the reality of "spending more on less.” It would be shortsighted to disregard the negative impacts of tariffs on the economy. Powell’s mention of “tariff inflation” introduces a potentially new concept into our economic discourse, one that may lead to even more complexities surrounding inflation expectations.

Navigating the Future: What’s Next for Investors?

At Extreme Investor Network, we understand that navigating these turbulent economic waters requires a sharp analytical lens. For investors, the question becomes: How do we protect our portfolios against inflationary pressures while capitalizing on opportunities present in a volatile market?

By keeping an eye on consumer sentiment and retail performance, investors can gain insights into broader economic trends. While Powell may maintain his belief in a quick resolution to inflation, the reality on the ground suggests a more cautious approach. Engaging with our community means staying informed and equipped with the knowledge necessary to make sound investment decisions.

Join the Extreme Investor Network as we delve deeper into economic trends, dissecting the complexities of inflation, consumer behavior, and what it means for your investments. By staying ahead of the curve, you can position yourself for financial success in the face of uncertainty.

Conclusion

With the Fed’s trajectory uncertain and consumer confidence shaky, understanding the dynamics of inflation and spending is crucial. Whether you’re a seasoned investor or just beginning, our insights at Extreme Investor Network will empower you to navigate the complexities of today’s economy confidently. Stay informed, stay engaged, and let us guide you toward successful investment strategies.