Market Update: A Rocky Finish to a Banner Year for U.S. Stocks

As we close the book on a dramatic year for U.S. equities, it’s impossible to overlook the latest turbulence in the stock market. What was once hailed as a strong rally in the tech sector is now showing signs of strain.

The S&P 500 recently experienced its third drop of more than 1% within an eight-day span, driven largely by declines in major tech stocks like Apple, Microsoft, and Amazon. This downturn comes on the heels of the Federal Reserve’s tempered expectations regarding interest rate cuts, which has left investors feeling jittery as they approach year-end.

In contrast to the retreats witnessed in equities, the Treasury bond market showed resilience, with the yield on the 10-year note hovering around 4.55%. A surprise drop in the Chicago Purchasing Managers’ Index contributed to this positive trend in Treasury performance. Interestingly, housing data was a bright spot too; pending home sales saw positive gains for the fourth consecutive month, reaching their highest level since early 2023. This reflects a budding resilience in the housing market, even as broader indices face pressure.

Despite recent setbacks, the performance of the "Magnificent Seven" tech giants has bolstered the S&P 500, driving a remarkable 25% advance this year. Many market analysts express optimism, with none among the 19 strategists tracked by Bloomberg projecting a decline for 2025. “In times like these, prudent investors recognize the strength in remaining invested," notes Nicolas Domont, a Paris-based fund manager. “The U.S. market still shines as a beacon for growth stocks, with expected earnings promising encouraging outcomes.”

However, as we near the holiday season, trading has become more subdued, evidenced by the lackluster performance of Europe’s Stoxx 600 index and a reversal in Asian markets after five consecutive days of gains. Tim Waterer, Chief Market Analyst at Kohle Capital Markets, mentioned that “a bit of trepidation ahead of the new year” is palpable among traders, many of whom are looking to offload risky assets in light of uncertainties in international trade dynamics anticipated for 2025.

Turning a critical eye to global events, Asian stock Jeju Air experienced a dramatic decline following a tragic incident involving one of their Boeing 737-800 aircraft, resulting in significant losses for the airline and impacting Boeing’s share prices in U.S. trading.

Oil prices are inching upward amidst 2025’s looming risks; however, despite being confined to a narrow trading range, crude oil is on track for an overall loss this year. In contrast, gold is set to finish 2023 with one of its strongest performances in recent memory.

Key Upcoming Economic Data:

Investors should keep a close watch on critical reports scheduled for release this week, which include the following:

- Tuesday: China’s manufacturing and non-manufacturing Purchasing Managers’ Index (PMI) data.

- Wednesday: New Year’s Day holiday, market closures.

- Thursday: U.S. construction spending, jobless claims, and manufacturing PMI metrics.

- Friday: U.S. ISM manufacturing and light vehicle sales data.

Market Performance Snapshot:

-

U.S. Stocks:

- S&P 500: Down 1.1%

- Nasdaq 100: Down 1.3%

- Dow Jones Industrial Average: Down 1%

-

European Stocks:

- Stoxx Europe 600: Down 0.6%

-

Currency Movements:

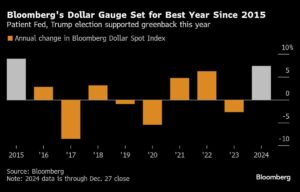

- Bloomberg Dollar Spot Index: Up 0.2%

- Euro: Down 0.4% against the dollar

- British Pound: Down 0.4% against the dollar

- Japanese Yen: Up 0.5% against the dollar

-

Cryptocurrency Trends:

- Bitcoin: Down 1.3% to $92,005.85

- Ether: Down 0.3% to $3,333.43

-

Bond Market Performances:

- 10-year Treasury yield: Declined to 4.55%

- German 10-year yield: Down to 2.36%

- UK 10-year yield: Declined to 4.61%

- Commodity Prices:

- WTI Crude: Up 1.1% to $71.38 a barrel

- Spot Gold: Down 0.9% to $2,598.88 an ounce

As end-of-year recalibrations commence and 2025 approaches, investors are encouraged to remain informed and flexible. The market’s ability to adjust to the economic landscape remains critical, and strategic positioning could yield significant insights and returns heading into the new year.