Are you tired of seeing your property taxes increase year after year without any substantial benefit? You are not alone, as many homeowners face the same frustrations of rising property taxes with no end in sight. But have you ever wondered about the history of property taxes and how they came to be such a significant source of income for local governments?

At Extreme Investor Network, we delve deep into the roots of property taxes, from ancient times to the modern era, to provide you with a comprehensive understanding of this complex system. Property taxes, just like Civil Asset Forfeiture laws, have a long history that dates back to ancient religious and feudal practices.

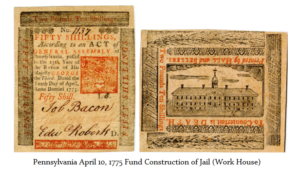

Did you know that in colonial America, property taxes were first imposed in the form of a levy on land in New Jersey, dating back to 1670? This early form of property taxation evolved over time, leading to the development of local tax systems to fund public services.

Furthermore, we explore how the concept of fairness and equality influenced the growth of property taxes. The idea that the rich should pay more in taxes based on their wealth value has deep roots in American history and has shaped our current tax system.

From the imposition of the Window Tax to the Tax on Steps, we uncover how taxes have influenced behavior and urban development throughout history. The emergence of income taxes, tariffs, and excise taxes during the Revolutionary War era paved the way for the modern taxation system we know today.

At Extreme Investor Network, we provide unique insights into the evolution of property taxes, shedding light on their impact on society and the economy. By understanding the historical context of property taxation, you can make informed decisions about your finances and investments in today’s ever-changing economic landscape.

Stay informed and empowered with the latest insights on property taxes and other economic trends by joining our network of savvy investors. Subscribe to our newsletter and start your journey towards financial success today.