Leveraged Finance Market Faces Turbulence: What Investors Need to Know

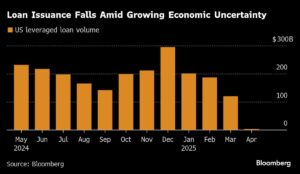

Recent developments in the leveraged finance market have raised serious concerns for banks and investors alike. It appears that deals that once moved swiftly through the pipeline are now hitting significant roadblocks, leaving banks grappling with the prospect of ‘hung’ debt—debt that lenders are stuck holding when they can’t sell it to investors. As the market enters uncertain waters, it’s crucial for investors to analyze the implications of these shifts and strategize accordingly.

Current State of Leveraged Finance

Leveraged finance markets have essentially come to a standstill, primarily as a reaction to escalating fears surrounding recession and the aggressive trade tariffs announced by former U.S. President Donald Trump. These tariffs signal changing dynamics in global trade, causing a ripple effect that extends far beyond the initial announcement. The financing efforts for some high-profile transactions, such as those involving Canadian auto-parts maker ABC Technologies and software provider H.I.G. Capital, have been delayed, leaving lenders exposed to unprecedented risks.

Kelly Burton, managing director at Barings, encapsulated the prevailing sentiment when she stated, “For the time being, we need things to calm down before new risk is put in front of investors.” It’s a sentiment echoed by many in the market—there’s a prevailing hesitance to commit new capital when uncertainty looms large.

Stalling Deals and Investor Sentiment

Banks like Citigroup and JPMorgan are facing pressure to close transactions by their set deadlines, but investor interest is waning. This lack of demand led to a failed $900 million leveraged loan sale, leaving financial institutions at risk of carrying these underwritten loans on their balance sheets. The implications are dire, especially given the high-stakes backdrop of looming deadlines.

Moreover, other attempts to refinance significant debt loads—for instance, Chuck E. Cheese’s $660 million junk debt—have also fallen flat. The overarching trend is clear: investors are increasingly cautious about consumer-facing companies and high-yield bonds, fearing a downturn that would leave them vulnerable.

The Global Perspective: A Mixed Landscape

Interestingly, European borrowers seem to be weathering the turbulent financial storm more effectively. Recently, banks managed to secure €7.45 billion to fund Clayton Dubilier & Rice’s acquisition of Sanofi’s consumer health arms. This demonstrates that while the outlook may be bleak for many, there are pockets of resilience in the market. The overall tone, however, has shifted dramatically since the trade tariffs announcement, which rattled investor confidence and saw major declines in U.S. high-yield bonds, marking the sector’s most significant slump since 2020.

In the aftermath of these developments, high-yield debt issuance in the U.S. has ground to a near halt. Investors are holding back, with only one new high-yield bond launched in the last six trading sessions—a clear sign of the times.

Key Takeaways for Investors

As the markets continue to evolve, here are a few critical insights for savvy investors looking to navigate this uncertain landscape:

-

Risk Assessment: Approach new investments with added scrutiny. Given the current volatility, weigh the risk versus reward more carefully than ever before.

-

Stay Informed: Remaining updated on geopolitical and economic events is paramount. Decisions made far from Wall Street can dramatically impact your portfolio.

-

Diversification is Key: If there’s one lesson to take from this market turmoil, it’s that diversification remains vital. Consider spreading your investments across various sectors and geographical markets to mitigate risks associated with a downturn.

-

Seek Alternative Solutions: Explore opportunities within robust markets, such as Europe, where certain sectors may offer more stability.

- Private Credit Opportunities: With traditional routes facing hurdles, consider looking into private credit options that could yield favorable returns with reduced competition for capital.

As we observe the ebb and flow of leveraged finance markets, it’s evident that resilience and adaptability will be crucial. The current situation may be daunting, but understanding the intricacies of these developments will empower investors to make more informed decisions and capitalize on new opportunities as they arise. Stay tuned to Extreme Investor Network for ongoing updates and insights, tailored to help you navigate the complex world of finance.