At Extreme Investor Network, we are constantly on the lookout for unique perspectives and insights into the world of finance. Recently, a Bloomberg Markets Live Pulse survey revealed some interesting findings about the role of US tech stocks as a hedge against inflation.

While gold has traditionally been seen as the go-to safe haven asset in times of rising prices, nearly a third of survey participants identified tech giants like Nvidia, Amazon, and Meta Platforms as their top choice for protection against inflation. These companies have solidified their position in the financial markets by consistently generating profits, which has led to positive investor sentiment and steady gains.

Despite a decrease in inflation levels from the highs of 2022, it still remains a top concern for investors, with 59% of respondents highlighting resurgent inflation as the biggest tail risk in financial markets for the remainder of the year. The upcoming consumer price index report is expected to show an inflation rate of around 3.4%, underscoring the importance of having strategies in place to combat price increases.

Tech stocks like Nvidia and Apple have seen significant growth since inflation first exceeded 2% in March 2021. However, these companies, along with other growth stocks, are sensitive to changes in inflation and interest rates, as their valuations are heavily reliant on future profits.

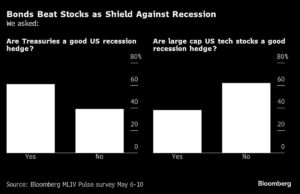

Looking ahead to potential risks in 2024, approximately a quarter of respondents pointed to a US recession as the top concern. In the event of a recession, Treasuries would offer a better shield compared to stocks, as indicated by the survey findings.

Despite the uncertainties in the market, the US remains an attractive destination for investors due to high bond yields and continued corporate profit growth. This influx of capital has led to a strengthening of the US dollar, which is widely regarded as the best currency for weathering market turbulence.

In terms of haven currencies, the US dollar received the highest preference from respondents, with the Swiss franc and Japanese yen lagging behind. The depreciation of the yen against the dollar, coupled with Japan’s accommodative monetary policy, has diminished its haven status in recent years.

The survey also touched on the role of gold as a hedge against geopolitical risks, with the People’s Bank of China and other countries seeking to diversify away from the dollar in light of recent global events. Gold has seen a 15% increase in value this year, highlighting its continued relevance as a safe haven asset.

Overall, the Bloomberg Markets Live Pulse survey provides valuable insights into investor sentiment and the evolving landscape of financial markets. Stay tuned for more updates on the latest trends and opportunities in the world of finance at Extreme Investor Network.