Indonesia’s Stock Market: An Investor’s Dilemma Amid Political Shifts

Indonesia was once where optimism soared high, drawing in investors eager for the continuity of pro-business policies anticipated under President Prabowo Subianto. However, the recent economic landscape reveals a starkly different picture, as soaring welfare expenditures begin to drain the nation’s finances, raising alarms about the broader implications for economic activity.

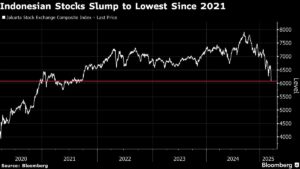

Just last week, a significant selloff in Indonesia’s stock market culminated in a trading halt—the first since the pandemic—and left many investors rattled. This downturn is not simply a market reaction; it is emblematic of a larger crisis of confidence in the political and economic trajectory of Southeast Asia’s largest economy.

Market Environment: Shifting Priorities and Investor Sentiment

As Prabowo pivots away from the pro-business roadmap established by former President Joko Widodo, uncertainty looms over new government priorities. The managing director of Change Global Investment LLC, Thea Jamison, articulates concerns that the transition in leadership lacks clarity and robust articulation of its economic agenda. Investors now find themselves weighing whether this recent selloff is a fleeting moment or a sign of deeper, structural challenges looming ahead.

Just a year ago, Indonesia’s benchmark Jakarta Composite Index was riding high, reflecting optimism about sustained growth and robust investment. Fast forward to today, and the index has plummeted by 21% from its September peak, raising questions about investability and the overall health of the market.

The Fiscal Tightrope: Challenges Looming Ahead

Increasing speculation about Finance Minister Sri Mulyani Indrawati’s potential resignation further deepens anxieties in an already fragile environment. Despite her denials, concerns over the nation’s public finances have intensified, particularly in light of an early-year budget deficit and a pronounced 20% drop in state revenues. With murky future budget allocations and an absence of innovative revenue-generating strategies, the economic outlook remains teetering on the edge of uncertainty.

Foreign investors have been quick to react, pulling almost $1.8 billion from Indonesian equities this year alone, exacerbated by external pressures such as a strengthening dollar and rising trade tensions. This fleeing capital has triggered a depreciation of the rupiah, which has fallen over 2% in 2023, mirroring a broader trend of declining market confidence.

Investor Reactions: Overcoming Apprehensions

While optimism briefly surged on Wednesday as the Jakarta Composite bounced back by about 1%, the recovery seems fragile and fleeting. Recent regulatory adjustments from the country’s securities agency to ease stock buyback rules for the next six months offer a glimmer of hope. However, this does little to address fundamental concerns surrounding fiscal discipline and governmental transparency.

Major shifts in budget priorities, including the establishment of the newly minted sovereign wealth fund, Danantara, has raised red flags amongst investors. With direct oversight from the President and control over significant portions of JCI Index constituents, fears of political interference and transparency risks loom over the investment landscape.

Bond Market Turmoil and Future Outlook

The investor anxiety has not been confined to equities alone; bond markets have also felt the strain. Recent reports indicated that spreads for dollar bonds issued by Indonesian firms reached their widest levels in six months. In response to market volatility, PT Bank Tabungan Negara made the prudent decision to withdraw a planned dollar bond issuance, further reflecting the unease currently permeating the financial landscape.

The outlook for Indonesian equities remains precarious, as evidenced by Goldman Sachs’ recent downgrade from overweight to market weight, attributing this shift to heightened policy uncertainties and weaker earnings forecasts. Chetan Sehgal, a portfolio manager at Franklin Templeton Investments, underscores the prevailing apprehension following the government’s transition, stressing the need for leadership to restore credibility amongst investors.

What Lies Ahead: Monitoring Central Bank Moves

As investors brace for the central bank’s upcoming monetary policy meeting, anticipation builds for potential measures to stabilize the market and reignite growth. The hope is that clear direction and decisive action can reinvigorate confidence, paving the way for renewed investment flows into Indonesia.

While the narrative around Indonesia’s economic landscape is one of caution, the opportunities that arise from navigating these challenges could be significant for those ready to engage with resilience. Keeping a keen eye on political developments, fiscal policy adjustments, and market responses will be crucial for any savvy investor looking to make informed decisions in the evolving Indonesian financial arena.

In conclusion, while the road ahead may be fraught with obstacles, recognizing the underlying potential within Indonesia’s economic framework can empower informed investment choices that align with long-term goals. Whether you’re a seasoned investor or new to the scene, staying attuned to these developments will be key in navigating Indonesia’s volatile market terrain effectively.