Stock splits have become a common trend among companies in the artificial intelligence (AI) sector, and Super Micro Computer (NASDAQ: SMCI), also known as Supermicro, recently announced a 10-for-1 stock split effective Oct. 1. While this news is exciting, there are compelling reasons to consider investing in Supermicro even before the split occurs.

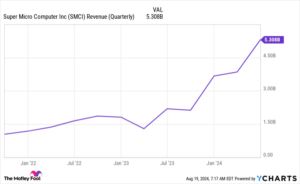

One of the key factors driving Supermicro’s growth is the high demand for its data center products. While Nvidia may be the focus of AI infrastructure discussions, Supermicro is also benefiting from these tailwinds. Their highly configurable servers and energy-efficient products have set them apart from the competition, leading to substantial revenue growth over the past year.

Looking ahead to fiscal 2025, Supermicro’s management expects significant revenue growth, with projections ranging from $6 billion to $7 billion in the first quarter and $26 billion to $30 billion for the full year. These numbers represent substantial year-over-year growth and demonstrate the company’s position in a rapidly expanding market.

Despite a recent drop in stock price following the Q4 2024 earnings announcement, Supermicro’s stock is still priced relatively cheap compared to its peers, trading at 18.4 times forward earnings. This valuation presents a buying opportunity for investors, especially considering the potential for earnings growth and margin recovery over the next year.

Before investing in Super Micro Computer, it’s essential to consider the insights provided by the Motley Fool Stock Advisor team. While Supermicro may not be among their top 10 stock picks, the Stock Advisor service has a track record of success, consistently outperforming the S&P 500 since 2002. By following their recommendations, investors have the potential to achieve significant returns over time.

In conclusion, Super Micro Computer’s stock split news is just one part of the picture. With strong demand for their products, projected revenue growth, and a compelling valuation, now may be an excellent time to consider adding Supermicro to your investment portfolio. By staying informed and leveraging expert advice, investors can position themselves for success in the ever-evolving world of finance and technology.