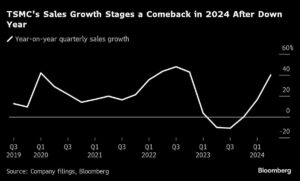

Taiwan Semiconductor Manufacturing Co. (TSMC) is on a roll, with its revenue soaring by a impressive 45% in July. This growth has not only outpaced the previous quarter but has also raised hopes for continued strong demand for AI chips from major players like Nvidia Corp.

As a key player in Taiwan’s tech industry, TSMC is a crucial indicator of the demand for AI technology. The company supplies chips to leading accelerator makers such as Nvidia and Advanced Micro Devices Inc., as well as being the sole processor supplier for Apple Inc.’s iPhones. With the mobile device market recovering from the pandemic-induced lows, TSMC’s recent revenue surge has exceeded analyst projections for the third quarter.

TSMC’s CEO, C.C. Wei, has expressed optimism about the company’s future prospects, suggesting that there may be room for price increases as more customers adopt its advanced technology. High-performance computing, particularly AI, has been a major driver of TSMC’s revenue, accounting for over half of its total earnings last quarter.

Despite the positive outlook, concerns have arisen among investors about the potential returns on the massive investments made by tech giants in AI infrastructure. Additionally, delays in Nvidia’s development of new AI chips have raised doubts about the progress of this emerging technology.

Recent economic uncertainties have also impacted the AI sector, leading to a temporary dip in TSMC’s stock value. However, the company has since bounced back, with savvy investors seeing the downturn as a buying opportunity.

At Extreme Investor Network, we keep a close eye on the latest developments in the finance and tech sectors. Stay tuned for more insights and analysis on top trends and opportunities in the market.