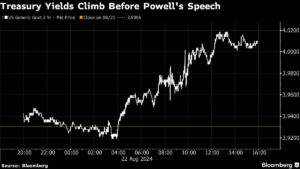

The anticipation is palpable as investors eagerly await Jerome Powell’s speech at the annual symposium in Wyoming. Will he hint at possible interest rate cuts by the Federal Reserve? This question has been the topic of discussion all week, causing fluctuations in both stock and bond markets.

As the market speculates over Powell’s remarks, Futures on the S&P 500 saw a 0.4% rise, and Europe’s main equities benchmark also edged higher. The 10-year Treasury yield remained steady at 3.84%, while the dollar retreated slightly. Keeping investors on their toes, Bank of Japan Governor Kazuo Ueda’s hawkish comments led to a strengthening of the yen.

The latest US economic data presents a mixed bag – jobless claims indicate a gradual cooling of the labor market, while manufacturing activity witnessed a sharp decline. On a more positive note, existing-home sales showed an increase for the first time in five months.

Despite the mixed signals, swaps traders are already pricing in nearly 100 basis points of cuts through December, reflecting market expectations for potential rate cuts by the Fed.

In the midst of all the volatility, the Japanese yen surged against the dollar as BOJ Governor Ueda hinted at the possibility of interest rate hikes if economic and inflation data align with predictions. Japanese inflation data also exceeded forecasts, further impacting the currency’s strength.

Looking ahead, key events this week include US new home sales and Jerome Powell’s speech in Jackson Hole. Investors are closely watching for any hints or clues that could shape the future direction of monetary policy and market trends.

As the market continues to react to ongoing developments, Extreme Investor Network will keep you updated with expert insights and analysis to help you navigate the ever-changing landscape of finance and investments. Stay tuned for more exclusive content and valuable information to help you make informed decisions and achieve your financial goals.