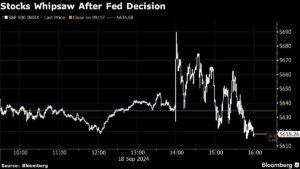

The recent half-point rate cut by the Federal Reserve has sent ripples through the Asian equities market, with Japanese equity futures rising and US benchmark contracts climbing to recover losses from the previous day. This rate cut, the first in over four years, has also signaled potential further policy easing in the coming months.

Market projections indicate that there may be an additional 50 basis points of cuts across the remaining two policy meetings this year, despite the Fed’s caution against assuming continued significant rate cuts. The movement in Treasury yields and other key indicators suggests that traders are closely monitoring the Fed’s actions to gauge the potential impact on various asset classes.

In response to the rate cut, various global markets experienced fluctuations. From stocks to Treasuries, commodities to cryptocurrencies, the impact of the Fed decision was felt across the board. Gold prices pulled back from a record high, while oil prices were influenced by signs of weak demand amidst escalating tensions in the Middle East.

Amidst this economic backdrop, the Asian markets are also influenced by other significant developments, such as the Hong Kong Monetary Authority’s rate cut following the Fed’s decision, and New Zealand’s shrinking economy in the second quarter. These factors, along with upcoming data releases and rate decisions in the region, are poised to further shape market sentiments in the coming days.

As we navigate these dynamic market conditions, it is essential to stay informed and adapt to changing landscapes. At Extreme Investor Network, our team of experts is dedicated to providing in-depth analysis and actionable insights to help investors make informed decisions in today’s ever-evolving financial landscape. Stay tuned to our platform for the latest updates and expert perspectives on all things finance.