Market Update: Global Equities Struggle Amid Uncertain Economic Signals

Asian equities faced declines today, continuing a trend of bearish sentiment that has impacted markets across Europe and the United States. Traders are reassessing their expectations regarding potential interest rate cuts by the Federal Reserve following the release of Friday’s robust payroll data. This has set the stage for heightened market volatility, particularly as we navigate the implications of unfolding geopolitical events.

The Asian Markets React

The MSCI Asia Pacific Index experienced a significant drop, trailing lower for the fourth consecutive day. With declines reported across the board, the index reflects a cumulative loss of over 3% this month so far. The performance is closely tied to ongoing uncertainties surrounding future monetary policies and the broader implications of recent employment figures, as Fed Chair Jerome Powell’s signals suggest a more hawkish stance may be forthcoming.

Eugenia Victorino, head of Asia strategy at Skandinaviska Enskilda Banken AB, emphasized in an interview that the market narrative is shifting away from aggressive rate cuts by the Fed, highlighting that uncertainty surrounding upcoming Trump administration policies continues to loom large.

Oil Prices Surge Amid Sanctions

Meanwhile, oil has reached a four-month high with Brent crude trading above $81 a barrel, primarily driven by intense U.S. sanctions against Russia’s oil industry. April’s restrictions on key exporters and extensive targeting of insurance firms and tankers indicate a tightening supply that could push prices higher. As we monitor these developments, investors should remain alert to potential impacts on global energy markets and inflationary pressures, particularly as oil prices are historically correlated with consumer price inflation.

The Currency Arena

The British pound extended its decline, sinking to a fresh low of $1.2126, a level not seen since November. This drop can be attributed to a slowing economy coupled with mounting fiscal and current account deficits, as pointed out by Christopher Wong, a foreign exchange strategist at Oversea-Chinese Banking Corp. The pound’s struggles are a stark reminder of the pressures currencies can face in today’s complex economic environment.

In contrast, the Bloomberg Dollar Spot Index climbed to a two-year high, fueled by these dynamics as investors gravitate towards the perceived safety of the U.S. dollar amid global uncertainty.

Bond Market Movements

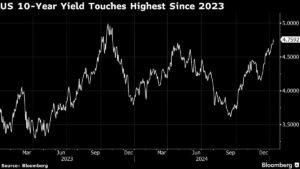

Bond markets also reflected sentiment shifts, with Asian bonds declining following last week’s uptick in U.S. Treasury yields. Australian 10-year bond yields rose 12 basis points to 4.66%, demonstrating the growing market expectations of a more aggressive monetary policy stance by the Fed. Interestingly, the recent movements in Treasury yields, particularly the 30-year yield surpassing 5% for the first time in over a year, are critical indicators for market participants to watch closely.

In response to its currency’s challenges, China has reinforced its support for the yuan through modifications to capital controls and market management strategies, signaling a proactive approach to stabilize the currency and maintain economic confidence.

What’s Next?

Looking ahead, traders should mark their calendars for pivotal U.S. inflation data set to be released on Wednesday, which will further clarify the Fed’s policy trajectory. This week also features significant economic indicators across different sectors globally, including CPI reports from the Eurozone and Great Britain, which could influence investor sentiment as we approach the end of the month.

Key Economic Events This Week:

- Monday: India CPI

- Wednesday: U.S. and UK CPI, Eurozone Industrial Production

- Thursday: Australia Unemployment, U.S. Jobless Claims

- Friday: China GDP, Retail Sales, U.S. Housing Starts

Conclusion

As we navigate these turbulent waters, it becomes crucial for investors to stay informed and prepared to adjust strategies in response to the evolving economic landscape. The Extreme Investor Network remains committed to providing in-depth analysis and actionable insights to help you make informed investment decisions during these uncertain times. Stay tuned for more updates and expert opinions as we delve deeper into market trends, strategies, and forecasts that matter to you.