Market Update: Tech Giants Face Turbulent Times Amid Year-End Selloff

As 2024 rolls to a close, the stock market’s last stretch is proving to be rocky, particularly for the largest names in technology. The S&P 500 dropped by 1.6%, while the Nasdaq 100 experienced a sharper decline of 2% as investors reacted to a selloff in major tech stocks. This decline arrived after a year where tech giants, commonly referred to as the “Magnificent Seven,” significantly contributed to more than half of the S&P 500’s performance, showcasing their dominance through a remarkable rally.

Trading Environment and Market Sentiment

Trading volumes were notably light, creating an environment where market movements could be exaggerated. Kenny Polcari from SlateStone Wealth noted that this week is characterized by its proximity to the holiday season, a time when many investors choose to step back. His advice? “Don’t make any major investing decisions this week.”

While the market has lost some of its euphoric momentum, the sentiment appears cautiously optimistic among financial advisors. Tom Essaye from The Sevens Report remarked on the need for a balanced outlook moving into the new year, which could reduce the so-called “air pocket risk.” However, he warned that a sudden wave of negative news, particularly regarding economic policy or interest rate cuts from Federal Reserve officials, might lead to swift market declines.

A Close Watch on the Magnificent Seven

In terms of individual performance, stocks from iconic tech companies like Tesla and Nvidia faced significant losses alongside the overall decline. Analysts are betting on ambitious earnings growth for these firms, with projections suggesting nearly 30% growth in the tech sector for the upcoming year. Yet, given the substantial market-cap share of tech stocks within the S&P 500, higher growth targets of around 40% are likely already priced in, which raises questions about sustainability.

Jason Pride and Michael Reynolds at Glenmede highlighted concerns regarding elevated valuations, cautioning that excessive premiums leave these stocks vulnerable if earnings begin to miss expectations. They advised that amidst such concentrated market performance, diversification should remain a core strategy for investors.

Trends and Movements in Different Asset Classes

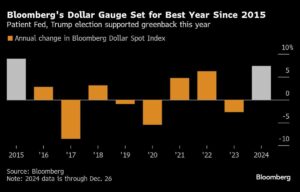

As the markets adjust, we have observed noteworthy trends in various asset classes. Bond yields have seen slight increases, with the 10-year Treasury yield rising two basis points to 4.61%. The Bloomberg Dollar Spot Index remained stable, indicating a cautious but steady environment for currency trading.

Cryptocurrency markets are also reacting to the broader economic landscape, with record-high redemptions from crypto funds, suggesting that a risk-off mentality may be setting in among investors. Bitcoin and Ether fell, indicating a potential retreat from this highly volatile asset class as traders reassess their strategies.

Conclusion

The current market dynamics indicate a cautious atmosphere as end-of-year adjustments take place. Despite record earnings forecasts and the promise of new technologies such as AI driving future growth, the elevated valuations across sectors, particularly in tech, could act as a double-edged sword. Investors are advised to remain vigilant, balancing their portfolios and staying informed of market trends that could influence next year’s performance.

As we transition into 2025, understanding these fluctuations and trends will be crucial for making strategic investment decisions. Navigating the complexities of the market is an ongoing journey, and with the right insights and strategies, you can position yourself for sustained growth and protection against volatility.

Stay tuned for more updates and actionable strategies from Extreme Investor Network, where informed investing empowers your financial future.