Market Dynamics: A Look at the Current Landscape

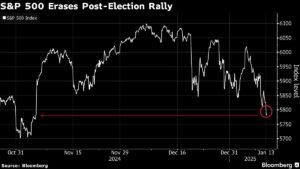

The recent fluctuations in the S&P 500 Index have sent shockwaves through Wall Street, raising serious concerns among investors. On one hand, the index briefly dipped below its closing value from November 5, 2016, which marked the day before Donald Trump’s first election victory—a precedent that underscores the cyclical nature of market sentiment and investor response to political change.

Economic Outlook and Investor Sentiment

As of now, the S&P 500 closed at 5,836.22—just slightly above the significant 5,782.76 from Election Day. This return to pre-election levels, combined with rising stock sell-offs, has been primarily fueled by fears of persistent inflation. Recent employment data has only compounded these concerns, leading many to speculate that the Federal Reserve may need to reconsider its stance on rate cuts this year.

The market saw a brief low of 5,773.31, but managed to recover somewhat, demonstrating the underlying volatility. However, this is a stark reminder of how swiftly investor sentiment can shift. Analysts suggest that various factors—including deteriorating economic forecasts, high stock valuations, and uncertainty around the Federal Reserve’s policies—are contributing to this choppy market environment.

The Impact of Rising Interest Rates

The bond market is reflecting similar anxiety, as yields for long-term Treasuries have crested above 5%. Particularly, the policy-sensitive 10-year yield has risen to levels not seen since late 2023, indicating investor concerns over monetary policy direction. A rising Cboe Volatility Index (VIX), hovering around 20, further reinforces this sense of market unease, suggesting that traders are hedging against increased volatility.

In this landscape, financial strategists point towards a reality check. Michael O’Rourke, chief market strategist at JonesTrading, emphasizes that the initial exuberance for Trump’s policies is fading as the realization sets in that translating campaign promises into actionable legislation is fraught with complexity.

Tariffs: The New Economic Reality

One of the most polarizing topics on the table is the potential introduction of tariffs, a policy that historically creates friction in global trade and could derail economic growth. Investors generally despise tariffs; as these tend to increase costs for consumers and businesses alike, there’s a palpable sense of discomfort regarding the implications of these policies unfolding.

In comparison to Trump’s first term, the current economic climate features high valuations and elevated interest rates. The S&P 500 has surged over 50% since the end of 2022, reflecting a notable boom that differs significantly from the relatively calmer market conditions that characterized his first inauguration, when the 10-year Treasury yield stood at 2.47%.

The Role of Political Turmoil

Recent political events are also causing concern. Ongoing disagreements within the Republican party regarding key issues, including immigration and government spending, are a constant reminder of the unpredictable nature of governance. This uncertainty could impact pro-growth initiatives that the market had anticipated.

Tom Essaye, founder of Sevens Report Research, pointed out that these political dramas could negatively affect investor confidence, ultimately leading to a reevaluation of growth projections. Higher interest rates and inflationary pressures could establish a new normal, potentially complicating the relationship between market growth and government policy.

A Dual Outlook

Despite these current challenges, there exists a silver lining for investors willing to navigate this complex landscape. On one side, the hope is that Trump’s desire for favorable market performance—viewing it almost as a referendum on his presidency—could mitigate drastic economic policies if they trigger adverse market reactions.

David Bahnsen, chief investment officer at the Bahnsen Group, notes that if Trump perceives that certain policies may harm market stability, especially regarding tariffs, he might pivot to more market-friendly approaches. This creates a unique dichotomy—investors are hopeful yet wary, with an eye on the implications of new economic policies.

In Conclusion

In summary, investors today are faced with a markedly different market ecosystem than those who experienced the euphoria of 2017. Navigating through volatile conditions, rising interest rates, and shifting political winds will require astute decision-making and informed strategies. As economic factors evolve, and as we continue to monitor market signals and government policies, staying informed through resources such as Extreme Investor Network could provide crucial insights for making savvy investment decisions in these uncertain times.