Are you looking for insights into upcoming stock splits to potentially enhance your investment strategy? At Extreme Investor Network, we are here to provide you with unique and valuable information on the upcoming stock splits for the week of September 30 to October 4.

Stock splits can be an intriguing corporate action that can significantly impact the share price and market capitalization of a company. A stock split involves issuing additional common shares to increase the number of outstanding shares, leading to a decrease in the stock price while maintaining the market capitalization. On the other hand, a reverse stock split consolidates the number of outstanding shares, thereby increasing the share price.

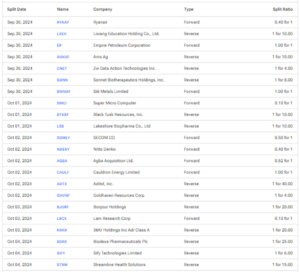

Companies often undertake stock splits to enhance the liquidity of their common shares and make them more accessible to retail investors. Let’s dive into some of the upcoming stock splits for the week:

-

Ryanair Holdings (RYAAY): Dublin-based Ryanair Holdings, a low-cost air carrier, announced a five-for-two stock split of its American Depositary Shares (ADS) on September 15. The stock split will change the ratio from one-to-five to one-to-two, effective September 30.

-

Lixiang Education Holding Co. (LXEH): China-based Lixiang Education Holding revealed a one-for-ten reverse stock split of its ADS on September 26, changing the ratio from one-to-ten to one-to-100, effective September 30.

-

Empire Petroleum (EP): Empire Petroleum, a production-driven oil and gas company, announced a rights issue of its shares in a 1:1 ratio, with an ex-date of September 30 to raise capital.

-

ams OSRAM (AUKUF): Austria-based ams OSRAM AG, a semiconductor company, approved a ten-for-one reverse stock split of its common shares, effective September 30.

-

ZW Data Action Technologies (CNET): ZW Data Action Technologies, previously known as ChinaNet Online Holdings, announced a one-for-four reverse stock split of its common stock to regain compliance with Nasdaq’s minimum bid price requirement, effective September 30.

-

Sonnet Biotherapeutics (SONN): A clinical-stage biotechnology company, Sonnet Biotherapeutics, disclosed a one-for-eight reverse stock split of its common shares, effective September 30.

- Si6 Metals (BWNAF): Australia-based Si6 Metals announced a 1:1 rights issue to raise funds for exploration at its projects and seeks approval for a one-for-20 reverse stock split in the future.

At Extreme Investor Network, we provide exclusive insights and analysis on upcoming stock splits to help you make informed investment decisions. Stay ahead of the curve and visit our website for more in-depth information on historical and upcoming stock splits. Trust Extreme Investor Network for expert guidance in the world of finance.