Market Update: Federal Reserve’s Shift Sends Markets Tumbling

In a dramatic turn of events, the Federal Reserve’s most recent decision on interest rates has left the markets reeling. On Wednesday, the Fed’s decision to forecast fewer interest rate cuts for the coming year plunged US stocks and sent Treasury yields soaring, marking the S&P 500’s worst performance on a rate decision day since 2001.

The S&P 500 index fell below the critical 6,000 mark, suffering a notable 2.9% drop by the end of the trading day. Meanwhile, the tech-heavy Nasdaq 100 recorded a staggering decline of 3.6%, its most significant drop in five months, with notable tech giant Micron Technology Inc. faltering after a lackluster earnings report.

Key Economic Indicators on the Move

The day saw the yield on the two-year US Treasury spike 10 basis points to reach 4.35%, while the 10-year Treasury yield climbed as well, hitting levels not seen since May. Additionally, the Bloomberg Dollar Spot Index surged, achieving its highest point since November 2022. This volatility underscores the market’s sensitivity to Federal Reserve moves and inflationary concerns.

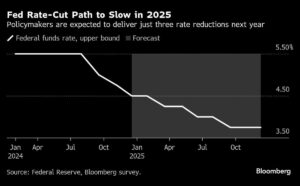

Despite a widely anticipated quarter-point rate cut, Fed Chair Jerome Powell’s statements following the Federal Open Market Committee (FOMC) meeting revealed an increasing reluctance to ease monetary policy too aggressively. Powell emphasized that the central bank is committed to achieving its 2% inflation target, making it clear that patience is a virtue in the current economic landscape.

"We need to see progress on inflation," Powell stated firmly. "While we moved quickly to attain these adjustments, we are adopting a more measured pace moving forward." This cautious approach has left many investors on edge.

Historical Perspective

The rapid decline of the S&P 500 on Wednesday mirrors historic shifts, with the last comparable drop occurring on September 17, 2001, following the tragic events of 9/11. The pandemic’s onset in March 2020 also witnessed significant market turmoil, highlighting the sensitivity of equity markets to Fed decisions.

Max Gokhman, a senior vice president at Franklin Templeton Investment Solutions, aptly described Powell’s current stance as "a hawk in dove’s clothing." Gokhman elaborated that while the Fed acknowledges recent economic strength, there remains an urgency to factor in potential inflationary pressures, including the prospect of higher tariffs that may follow a political shift after the upcoming elections.

Looking Ahead: What to Expect

Market experts, including Whitney Watson of Goldman Sachs Asset Management, suggest that the Fed may take a more conservative approach to rate cuts heading into the new year. Watson forecasts that a rate cut may not occur until March, as the Fed seems poised for a gradual pace of easing.

As we navigate these uncertain waters, several key economic events are on the horizon that investors should keep an eye on:

- Japan’s rate decision on Thursday

- UK Bank of England’s policy meeting

- Revised US GDP figures

- Japan’s Consumer Price Index and China’s loan prime rates

- Eurozone consumer confidence and US personal income data to be released this Friday

Market Overview

The sweeping effects from the Fed’s announcements were evident across various markets. By 4:01 PM New York time:

- The S&P 500 dropped by 2.9%

- Nasdaq 100 experienced a decline of 3.6%

- The Dow Jones Industrial Average fell by 2.6%

- The MSCI World Index also saw a drop of 2.6%

In currency markets, the Bloomberg Dollar Spot Index rose by 0.9%, while major currencies like the Euro and British Pound fell against the dollar. In cryptocurrency, Bitcoin and Ether faced significant drops, with Bitcoin decreasing by 5.2% and Ether by 6%.

As we move forward, it’s crucial for investors to stay informed and adaptable in this rapidly evolving economic environment. Keeping abreast of both domestic and global financial developments, as well as incorporating expert analyses from trusted sources like Extreme Investor Network, will be essential in navigating these turbulent times. Make sure to follow our updates for more insights and strategies for your investment journey.