When it comes to investing in stocks, it’s crucial to stay informed about the latest developments and changes in the market. One company that has recently experienced a sharp decline in its stock price is Super Micro Computer (NASDAQ: SMCI). After starting the year strong, the stock has lost nearly 60% of its value from its peak, leaving many investors questioning whether it’s a good buy at its current price.

Several factors have contributed to Super Micro Computer’s recent struggles. First, the company’s fourth-quarter results for fiscal 2024 fell short of Wall Street’s expectations, leading to a disappointing guidance from management. Additionally, a report from short-seller Hindenburg Research raised concerns about accounting irregularities at Supermicro, causing further uncertainty among investors. The company also announced a delay in filing its annual report, adding more negative sentiment to the stock.

Despite these challenges, there are reasons for opportunistic investors to consider buying Super Micro Computer at its current valuation. The stock is trading at an attractive multiple of 22 times trailing earnings and 13 times forward earnings, making it a potentially compelling investment opportunity.

It’s important to address the allegations made by Hindenburg Research, considering the short-seller’s financial interest in driving down Supermicro’s stock price. While the company has faced scrutiny from the Securities and Exchange Commission (SEC) in the past for accounting violations, Supermicro has made significant progress in recent years, driven by the growth of artificial intelligence (AI) technology.

In fiscal 2024, Super Micro Computer reported a substantial increase in revenue to $14.9 billion and non-GAAP earnings of $22.09 per share. Management remains optimistic about the company’s future prospects, highlighting a strong backlog of design wins and market-leading positions across various segments. Supermicro expects to continue its growth trajectory in fiscal 2025, with revenue projected to range between $26 billion and $30 billion.

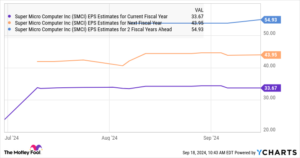

While Super Micro Computer faces margin challenges due to increased investments in capacity expansion, analysts anticipate significant earnings growth in the current fiscal year and beyond. Despite recent downgrades from Wall Street analysts, the company’s long-term growth potential in the AI server market remains promising.

Finally, investors should consider their risk tolerance and investment goals before deciding to buy Super Micro Computer stock. Risk-averse investors may prefer to wait for more clarity on the company’s financials, while those seeking a high-growth opportunity in the tech sector could find Supermicro appealing at its current valuation.

At Extreme Investor Network, we provide expert insights and analysis on the latest trends in the financial markets, helping investors make informed decisions about their portfolios. Stay ahead of the curve with our unique perspectives on investment opportunities and market dynamics. Join us today for exclusive content and resources to supercharge your investment strategy!