The recent turmoil in the Japanese equities market has certainly caught the attention of investors worldwide. With a record three-day loss of $1.1 trillion in value at the beginning of August, many are wondering if this dip is an opportunity to buy into one of the hottest trades of 2024.

The stocks that saw the biggest drops were the ones that had previously experienced significant gains, bringing prices down to more attractive levels. This correction has not only made Japanese shares more internationally appealing but has also removed some of the froth from the $6.1 trillion market.

The Bank of Japan’s unexpected interest rate hike last month initially unsettled traders, but subsequent comments from the central bank reassured investors that further tightening would not happen too quickly to avoid market instability. This has helped curb sudden spikes in the strength of the yen, which in turn reduces a key threat to the stock market rally.

Global catalysts such as optimistic US labor market data and major technology companies investing heavily in artificial intelligence infrastructure have also played a role in shaping market sentiment. Despite the recent downturn, Tetsuro Ii, CEO of Commons Asset Management Inc., believes that the market could recover fully within just two or three months. Investors are beginning to recognize that monetary policies in Japan and the US have entered a new phase, prompting them to adjust their positions accordingly.

The Topix benchmark has dropped by 12% since the end of June, with certain sectors like semiconductor-related stocks and banks experiencing even larger declines. While some experts caution against calling this a bubble, others believe that the market simply got carried away and needed to correct itself.

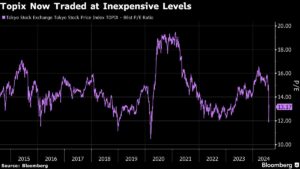

The recent slide in prices has made Japanese stocks more affordable, potentially enticing overseas investors like Warren Buffett who have shown interest in Japanese trading houses. The Topix is now trading at 13 times estimated forward earnings, compared to 20 times for the S&P 500 Index, making it appear more attractively valued.

Despite ongoing risks such as yen appreciation and geopolitical tensions between the US and China, sentiment in the derivatives market remains positive for Japan. Bullish bets on the Nikkei are on the rise, indicating growing confidence in a market rebound.

There’s no denying that the recent market volatility has shaken investors, but for those bullish on Japanese equities, the current weakness may present a buying opportunity. As prices adjust to more reasonable levels and positioning becomes lighter, many see this as a chance to capitalize on potentially undervalued assets.

At Extreme Investor Network, we understand the importance of staying informed and seizing opportunities in volatile markets. Our expert analysis and in-depth insights can help you navigate the ever-changing world of finance with confidence. Join us today and let’s make the most of these exciting investment possibilities together.