Are you ready to stay ahead of the game and make informed decisions in the world of finance? Look no further than Extreme Investor Network for the latest insights and analysis on market trends, stock movements, and global economic developments.

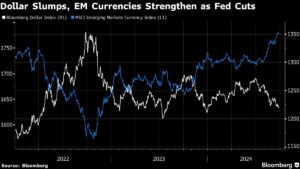

In recent news, US stock futures dipped slightly following the S&P 500 achieving its 41st record close of the year. The dollar and Treasuries remained stable amidst ongoing fluctuations in the market. Investors are eagerly awaiting new catalysts to drive market movements, especially after a recent interest-rate cut by the Federal Reserve.

One notable event is the probe by US officials into German software developer SAP SE and other companies for potential overcharging of government agencies over the past decade. This investigation adds a layer of uncertainty to the market, prompting traders to seek clarity on future developments.

Central banks across Europe are also in focus, with Sweden’s Riksbank cutting borrowing costs and hinting at further reductions in the near future. The European Central Bank is also expected to announce a rate cut in October, according to recent market expectations.

Investors are closely monitoring Federal Reserve Chair Jerome Powell’s upcoming comments for insights into future rate cuts. Swaps traders have increased their bets on more policy easing by the Fed by year-end, suggesting potential further cuts in the US monetary policy.

Meanwhile, China’s central bank has implemented various stimulus measures to boost its economy, including lowering interest rates and introducing a wide-ranging stimulus package. These actions have positively impacted commodities, with the Bloomberg gauge of commodities on an 11-day winning streak, the longest since January 2018.

At Extreme Investor Network, we provide expert analysis and strategic advice to help you navigate the dynamic world of finance. Stay informed, stay ahead, and make smart investment decisions with us. Join the Extreme Investor Network today for exclusive insights and expert guidance in the world of finance.