Electric Vehicle Stocks Experience a Surge: A Closer Look at Rivian, Wolfspeed, and Indie Semiconductor

On Thursday, electric vehicle (EV) stocks witnessed a noteworthy uptick, with companies like Rivian (NASDAQ: RIVN), Wolfspeed (NYSE: WOLF), and Indie Semiconductor (NASDAQ: INDI) leading the charge. By approximately 1:30 p.m. ET, Rivian had surged 5.7%, Wolfspeed was up a remarkable 14.9%, and Indie was not far behind with a 5.1% increase. While such movements can intrigue investors, it’s essential to understand the underlying factors contributing to these fluctuations.

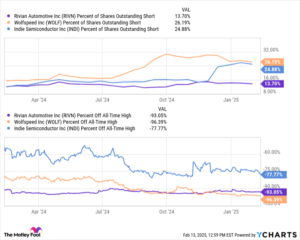

The absence of specific news announcements regarding these firms suggests that the market responded positively to incremental developments in the broader EV landscape. Given the severe declines these stocks have faced—Rivian and Wolfspeed down 93% and 96% respectively, and Indie Semiconductor plummeting 78%—even minimal good news can trigger significant buying activity. High short interest rates further fuel this dynamic; Rivian’s short interest stands at approximately 14%, with Wolfspeed and Indie at around 25%. This setup makes these stocks particularly susceptible to short squeezes amid a positive sentiment shift.

Analyzing the Investment Landscape

All three companies are heavily investing in their futures, striving to carve out a significant share of the burgeoning EV market. Rivian’s focus is on scaling its manufacturing capabilities, which incurs heavy costs. Wolfspeed is pouring resources into its U.S.-based silicon carbide chip production, but currently lacks substantial revenue to justify its expenditures. Indie Semiconductor, a small-cap entity, specializes in sensors and power chips that are pivotal for autonomy and electrification. Given their financial trajectories, these investments are a double-edged sword; they are necessary for long-term success but painful in the short run as these companies grapple with dwindling demand following last year’s substantial drop in EV sales.

Possible Catalysts for the Stock Rise

Speculation over the potential procurement of 400 armored electric vehicles by the State Department appears to have bolstered market optimism today. An initial report suggested that Tesla’s Cybertruck would be the primary contractor for this project, raising eyebrows due to Elon Musk’s connections with previous administrations. However, subsequent clarifications indicated that while the State Department had been gathering information since December regarding armored EVs, a formal bidding process has yet to commence.

What’s intriguing here is the narrative shift it could create. If the government starts leaning towards purchasing EVs, particularly from notable manufacturers, it could signal a growing acceptance of electric technologies within federal operations, countering some prevailing assumptions about the administration’s stance on EVs.

Caution is Key for Investors

It’s crucial to approach today’s rally in EV stocks with tempered enthusiasm. The current uptick may merely represent a "dead cat bounce" rather than the beginning of a sustained recovery. Analysts agree that a genuine resurgence in these stocks requires not just short-term speculation or market sentiment shifts, but healthier demand for EVs driven by technological advancements that make electric vehicles more affordable and appealing, alongside macroeconomic factors such as reduced inflation and lower interest rates.

Making Informed Investment Decisions

Before considering an investment in Rivian or any associated EV stocks, prospective investors should conduct thorough diligence. The current scenario presents risks alongside potential rewards; thus, seeking diversified opportunities might be wise. Notably, Rivian has not been included in some of the top stock picks by renowned investment advisory services, highlighting the cautious sentiment around its recovery prospects.

At Extreme Investor Network, we understand the importance of staying informed and making educated decisions. It’s vital to not just react to market movements but to analyze the underlying factors that drive them. As the EV sector continues to evolve, monitoring technological trends, government policies, and broader economic indicators will be essential for investors aiming to navigate this dynamic and potentially lucrative market successfully.

Conclusion

While the excitement surrounding Rivian, Wolfspeed, and Indie Semiconductor is evident, investors must proceed with a keen eye on future developments. Remember, the key to effective investing lies in understanding the broader context and historical data, rather than getting swept away by daily price fluctuations. Stay tuned to Extreme Investor Network for ongoing updates and expert insights into the ever-changing market landscape.