Welcome to Extreme Investor Network!

Are you looking for the latest insights and analysis on the Stock Market, trading, and Wall Street trends? You’ve come to the right place. Our team of experts is dedicated to providing you with valuable information that will help you make informed investment decisions.

Weekly Performance and Market Sentiment

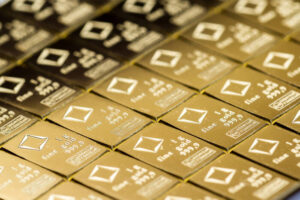

Gold has seen a significant 2.3% decrease this week, its largest weekly fall since early December. This decline follows a nearly $100 drop from its all-time high of $2,431.29 on April 12. The recent easing of the Middle East crisis has influenced market sentiment, leading to a decrease in the immediate demand for safe-haven assets like gold.

Economic Data Impact

The latest U.S. economic data has presented mixed signals, contributing to increased market volatility. IG market strategist Yeap Jun Rong notes a slowdown in economic growth alongside persistent inflation pressures. With first-quarter GDP growth at a modest 1.6%, below expectations, concerns over sustained inflation despite a softer economic environment have intensified.

Treasury Yields and Monetary Outlook

U.S. Treasury yields, particularly the 10-year and 2-year yields, have reacted to the market’s dual narrative of slower growth paired with stubborn inflation. The upcoming personal consumption expenditures (PCE) price index, a key inflation measure for the Federal Reserve, is eagerly anticipated and could impact the Fed’s interest rate decisions in the upcoming policy meeting.

Market Forecast

Looking ahead, the direction of gold prices will heavily depend on the PCE report and subsequent Federal Reserve actions. Higher inflation indicated by the PCE figures could lead to expectations of prolonged high-interest rates, potentially diminishing gold’s appeal. Conversely, easing inflation might reignite interest in gold as a hedge against currency devaluation. Currently, the market sentiment leans towards a bearish outlook for gold, especially if inflation continues unchecked.

Technical Analysis

Stay tuned for our in-depth technical analysis and insights into market trends. Our team of experts is dedicated to providing you with the information you need to succeed in today’s dynamic market environment. Make sure to subscribe to our newsletter for the latest updates and analysis.

Thank you for choosing Extreme Investor Network for all your investment news and analysis!