Outlook for Real Estate Stocks in 2025: A Necessity for Surgical Precision

The past couple of years have been nothing short of tumultuous for real estate stocks. Since the Federal Reserve initiated interest rate hikes in 2022, the housing market has faced a steep decline, as soaring borrowing costs crystallized into a formidable barrier. Yet, as we head into 2025, the narrative is shifting. While some sectors of real estate might struggle, there are pockets of opportunity that savvy investors can capitalize on.

The Age of the Stock Picker

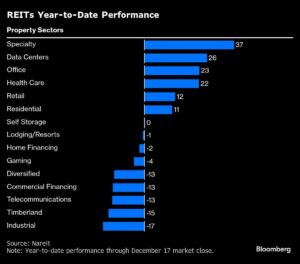

The outlook for 2025 isn’t an unequivocal disaster. According to experts like Adam White, a senior equity analyst at Truist Advisory Services, we’re looking at a stock-picker’s market. This indicates that while some stocks will flourish, others will falter, resulting in a diverse performance landscape. This complexity requires investors to be more discerning in their choices instead of taking a one-size-fits-all approach.

The Residential Market: Stubborn Challenges Ahead

The residential real estate sector is expected to continue grappling with high mortgage rates and tight supply. With Fed Chair Jerome Powell recently signaling fewer rate cuts in the near term, the possibility of lower mortgage rates seems increasingly bleak. Data from Freddie Mac confirms this trend, showing an uptick in the average 30-year fixed mortgage rate—the first spike in a month. This environment complicates the landscape for homebuyers and sellers alike.

Homebuilders, who enjoyed a remarkable 74% boom since the onset of the Fed’s rate hikes, are now facing a cooling market. As mortgage rates remain elevated, many homeowners find themselves reluctant to sell, locked in by lower rates. This has started to impact homebuilder stocks, which are expected to end the year down by 1.6%, contrasting sharply with their extraordinary gains in 2023.

Opportunities Amidst Decline: The Case for Office REITs

Interestingly, one of the most beleaguered segments now appears to be on the mend: office real estate investment trusts (REITs). As noted by Uma Moriarity, a senior investment strategist at CenterSquare Investment Management, office REITs are well-positioned to leverage their capital availability and strong asset portfolios. This is particularly true for trophy assets, which often reside within larger REITs’ holdings.

Despite the challenges of recent years—like the regional banking crisis and the reluctance of employees to return to the office post-COVID—office REITs are navigating this storm. U.S. office REITs are beginning to see a reversal of fortunes, with total returns exceeding 28% in 2024, making this sector one of the better performers following a dismal 2022 and 2023.

Moreover, the disparity is stark between high-quality office properties and lower-tier options. Notably, companies such as SL Green Realty Corp. and Vornado Realty Trust have reported staggering gains of 30% to over 50%, while less desirable assets have seen values plummet by as much as 85% this year.

The Cooling Luxury Market

While the office sector may be sparking optimism, the outlook for luxury residential properties paints a different picture. Influential figures like Cole Smead, CEO of Smead Capital Management, warn that high-end luxury real estate could be on a downward trajectory, which may signify broader market troubles ahead. Big-ticket items that have traditionally drawn affluent buyers might soon feel pressure, as rising borrowing costs begin to influence buyer behavior even in this segment.

What’s concerning is that the cash flow supporting many luxury transactions frequently comes from collateralized lines of credit—any hiccups in this ecosystem could trigger a scramble to liquidate assets. Smead’s insights suggest that such dynamics could lead wealthy homeowners to sell either their luxury properties or publicly held securities, which would ripple across the market.

A Proactive Approach to Investing in 2025

As we move into 2025, the advice from Truist’s White is clear: don’t merely pile into a sector fund. Instead, adopt a surgical approach in stock selection. Investment opportunities could lie in less conventional areas, such as data center REITs, real estate services firms, and senior housing REITs. This tailored strategy will likely yield better returns amid the expected volatility.

In summary, the real estate landscape for 2025 presents both challenges and openings. Investors equipped with the right strategies—focused on selective stock picking and aware of sector dynamics—could find themselves ahead of the curve. At Extreme Investor Network, we emphasize not just the importance of understanding these macro trends, but also the critical nature of individual asset analysis. As always, diligent research and a keen eye for opportunities will serve investors well in this complex environment.