Nvidia Corp., the chipmaker that has played a key role in the artificial intelligence boom, is set to make a significant move by joining the Dow Jones Industrial Average (DJIA), the oldest of Wall Street’s three main equity benchmarks. This announcement was made by S&P Dow Jones Indices late last Friday, with Nvidia replacing rival Intel Corp. in the prestigious index.

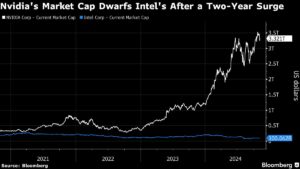

The inclusion of Nvidia in the DJIA is a testament to the remarkable growth the company has experienced, particularly driven by the AI-driven rally that has seen its stock price surge by an impressive 900% over the past two years. This move also marks the first time that Nvidia will be part of the DJIA, positioning it as a significant player in the US equity market.

As a leader in the AI space, Nvidia has been at the forefront of the technological revolution, securing a market value of $3.32 trillion, just shy of Apple Inc.’s valuation. With its continued growth trajectory, Nvidia could potentially surpass Apple as the world’s most valuable company in the near future.

On the other hand, Intel, which has been a member of the DJIA since November 1999, has been facing challenges in recent years. The company has been implementing a turnaround plan, including cost-cutting measures and job reductions, amid a decline in its stock price. In contrast, Nvidia’s success highlights the evolution of the DJIA to reflect the current market landscape and showcase companies that are leading in their respective industries.

Dow Inc., another company that is part of the DJIA, has been in the index since 2019 when it was spun off by DowDuPont. The addition of new companies like Nvidia and Sherwin-Williams Co. to the DJIA underscores the index’s efforts to stay relevant and reflective of the changing market dynamics.

At Extreme Investor Network, we recognize the importance of staying informed about market trends and developments that impact your investment decisions. As Nvidia makes its debut in the DJIA, we encourage our members to stay updated on the latest news and insights to make informed investment choices in today’s ever-evolving financial landscape.