Nvidia Prepares to Steal Apple’s Throne in Upcoming Earnings Announcement

As we gear up for another exciting tech earnings season, all eyes are on artificial intelligence (AI) powerhouse Nvidia (NVDA). The chip giant has seen its stock surge more than 16% in the past month, positioning itself to potentially dethrone Apple as the largest publicly traded company by market capitalization.

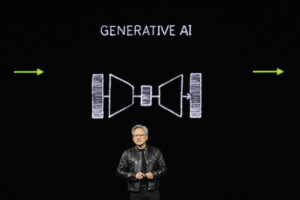

What’s fueling Nvidia’s meteoric rise? CEO Jensen Huang’s recent comments about the overwhelming demand for the company’s upcoming Blackwell chip have sent investors into a frenzy. While Nvidia’s stock hit $130 following these remarks, concerns about potential restrictions on AI chip shipments to certain countries by the Biden administration briefly dampened the rally before the stock rebounded.

Nvidia’s impressive stock performance and the substantial growth in data center sales over the past year have set high expectations for its upcoming earnings announcement, the date of which is yet to be confirmed.

In the fiscal Q3 of 2024, Nvidia reported a staggering 206% increase in overall revenue to $18.1 billion, with data center revenue soaring 279% to $14.5 billion. While the company isn’t facing a revenue decline, the rate of growth is expected to slow compared to the same period last year, which could unsettle some investors.

Taking a look back at Nvidia’s Q2 earnings announcement in August, even though the company exceeded revenue and earnings per share expectations, the stock plummeted over 6% immediately post-announcement. It took more than a month for Nvidia’s stock price to recover from this setback.

The AI sector has seen mixed performances, with Broadcom (AVGO) witnessing a 59% increase in its stock price year-to-date, Qualcomm (QCOM) climbing 19%, and AMD (AMD) gaining just 6%. On the flip side, Intel (INTC) struggled with a significant 55% decline.

Broadcom’s involvement in AI infrastructure and Qualcomm’s potential in on-device AI growth through AI smartphones and AI PCs have boosted their performances. AMD, as a competitor to Nvidia, offers an alternative in terms of price and availability.

Meanwhile, Intel is facing challenges amidst its major turnaround efforts to enhance its third-party chip fabrication capabilities and compete with Nvidia and AMD in the AI processor space.

As we eagerly await Nvidia’s earnings announcement, investors will closely monitor continued AI spending from tech giants like Microsoft (MSFT), Google (GOOG, GOOGL), Meta (META), and Amazon (AMZN). These companies account for a significant portion of AI sales, providing valuable insights into Nvidia’s chip demand.

Stay tuned for updates on Nvidia’s Blackwell rollout and any potential supply constraints, similar to those experienced with its Hopper chips. The upcoming weeks are sure to be filled with excitement and volatility in the tech sector. Prepare for the ride ahead.

For the latest updates on earnings reports, analysis, and company news, be sure to visit Extreme Investor Network for valuable insights and expert commentary on the finance industry. Don’t miss out on the latest financial and business news – stay informed with Extreme Investor Network.