Nvidia’s Latest Earnings: A Mixed Bag Amidst AI Boom

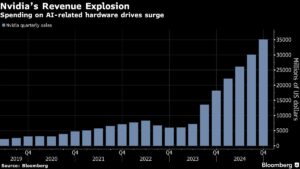

In the world of technology, Nvidia Corp. stands out as a key player in the rapidly growing AI sector. Recently, the chipmaker reported its quarterly earnings, which, while respectable, fell short of the explosive growth investors had come to expect. This nuanced performance has left many investors reassessing their positions in the context of a dynamic industry landscape.

Quarterly Sales and Market Response

Nvidia’s projected sales for the fiscal first quarter are approximately $43 billion, slightly above the average analyst estimate of $42.3 billion. While this performance aligns closely with expectations, some industry watchers had anticipated figures as high as $48 billion. The company’s guidance on gross profit margins raised some eyebrows, suggesting potential tightening as it expedites the release of its new chip, Blackwell. Such caution has pushed Nvidia’s shares down slightly—by less than 1%—in after-hours trading.

The Broader AI Landscape

Nvidia’s mixed quarterly performance comes against a broader backdrop of uncertainty in the AI sector. The company has faced headwinds, including concerns that data center operators may reduce spending. Additionally, an emerging competitive threat has arisen from the Chinese startup DeepSeek, which claims to be able to develop chatbots with far fewer resources, challenges that could jeopardize Nvidia’s dominance.

Despite these challenges, Nvidia executives maintain that they are poised for long-term growth. CEO Jensen Huang highlighted the extraordinary demand for the Blackwell chip, recently stating it represented the fastest product ramp in the company’s history—a promising sign for investors.

A Closer Look at Financials

In its fourth-quarter report, Nvidia achieved revenues of $39.3 billion, matching estimates but only surpassing them by a minor margin—the smallest since February 2023. Earnings per share came in at 89 cents, exceeding expectations of 84 cents. Notably, the data center unit, which has become Nvidia’s primary revenue generator, reported sales of $35.6 billion, comfortably beating projections of $34.1 billion.

Gaming-related revenues, once the backbone of Nvidia’s business, numbered only $2.5 billion, falling short of the anticipated $3.02 billion. Meanwhile, the automotive segment remained modest at $570 million, underscoring the need for Nvidia to innovate beyond graphics processors.

Future Outlook: Challenges and Opportunities

As the AI landscape dynamically shifts, industry analysts have begun to express mixed sentiments regarding Nvidia’s path forward. The introduction of the Blackwell chip, while promising, carries risks associated with supply challenges and manufacturing intricacies. Concerns over production, coupled with the DeepSeek discounting threat, have some analysts questioning the sustainability of Nvidia’s growth trajectory.

However, it’s important to highlight that significant clients like Microsoft have kept their capital expenditure plans intact, signaling a robust market for AI and data center technology. Huang remains optimistic, suggesting that the deepening capabilities and modeling of AI systems will create an expanding demand for Nvidia’s products.

Navigating Investor Sentiment

While Nvidia has consistently exceeded revenue expectations, there’s a growing sentiment among analysts that the company might find it challenging to maintain this level of performance. As Edward Jones analyst Logan Purk noted, future guidance from the company was perceived as slightly underwhelming, hinting at a recalibration in investor expectations.

In the wake of this recent earnings announcement, investors should take a balanced approach to Nvidia’s stock, weighing its historical performance against its current challenges. The commitment to innovation, particularly with the introduction of Blackwell, could position Nvidia favorably once production and supply chains stabilize.

The fluctuations in Nvidia’s performance underscore critical dynamics in the technology market. With a keen focus on the evolving landscape, staying informed about companies at the forefront of AI and technology can guide effective investment strategies. Whether navigating through headwinds or capitalizing on breakthroughs, it’s essential to keep a close eye on the developments that could shape the future of investing in this dynamic space.