Navigating the Nvidia Stock Selloff: Key Insights and Market Analysis

Nvidia Corp. has faced significant turbulence over the past month, resulting in a notable decline in its share price. This upheaval has captured the attention of market technicians who are closely analyzing crucial momentum indicators to assess the potential for further downturns.

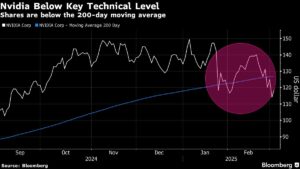

One essential metric under scrutiny is the 200-day moving average. This long-term momentum indicator, which was breached back in January for the first time in over two years, serves as a critical signal for traders. Currently, Nvidia’s stock is trading well below this moving average, prompting concern among professionals regarding its future performance.

Todd Sohn, senior ETF and technical strategist at Strategas Securities LLC, highlights the shift in momentum, stating, “It’s definitely a change of character compared to the last two years.” The 200-day moving average is often viewed as a barometer for market sentiment; when it starts to slope downward, it indicates that bullish momentum is fading. For traders, this is a red flag that alerts them to be cautious in their positions.

Beneath these technical considerations lies the immediate support levels that market watchers are keeping an eye on. Sohn has pinpointed the critical level at $113 per share, which corresponds to an intraday low from early February. Rick Bensignor, CEO of Bensignor Investment Strategies, echoes this sentiment, identifying support levels between $110 and $103, with the next significant level around $90.

Nvidia isn’t alone in this turbulent market environment. The stock’s decline aligns with a broader trend where significant technology companies—part of the so-called Magnificent Seven—have fallen into correction territory, with many stocks down over 10% from their recent peaks. The Nasdaq 100 Index is approaching similar levels of concern, reflecting a pervasive uncertainty in the tech sector.

Compounding Nvidia’s issues is the emergence of concerns related to DeepSeek and President Donald Trump’s tariffs on technology imports. These elements are creating a precarious environment for tech firms, particularly those that rely heavily on Chinese manufacturing and sales.

As of this writing, Nvidia’s struggles have been particularly impactful: the company accounts for over 30% of the Nasdaq’s decline this year. Other companies like Tesla Inc. and Broadcom Inc., which also trade near their 200-day averages, contribute to this trend, underscoring a widespread tech slump.

Buff Dormeier, chief technical analyst at Kingsview Partners, offers a more strategic observation: “It is possible we’ve seen a long-term peak in the stock.” While Nvidia continues to be viewed as a key player in the AI landscape, its stock is showing signs of fatigue, as evidenced by the flattening trend of the 200-day moving average.

Interestingly, Nvidia’s valuation has dropped significantly, with a forward earnings multiple of about 25, the lowest it has been in over a year. This is noteworthy compared to the Nasdaq’s wider forward earnings multiple of 22 and the S&P 500 Index’s multiple of approximately 20. Such valuation metrics could present an attractive buying opportunity, especially as the largest tech firms continue to invest heavily in artificial intelligence.

Bernstein analysts led by Stacy Rasgon voiced their confusion over the stock’s recent valuation decline, especially as it coincides with the launch of Nvidia’s new Blackwell line of chips. They argue that fears surrounding a potential AI trade downturn feel premature, suggesting that Nvidia’s valuation might indeed be underselling its growth potential.

However, as enticing as Nvidia’s current valuation might seem, caution is advised. Analysts from Citigroup, led by Atif Malik, suggest that while the risk-reward ratio appears appealing, investors should await a resolution regarding AI restrictions and potential tariff impacts before committing capital.

As this story unfolds, tech investors must stay vigilant, not only watching Nvidia but also the broader landscape of technology stocks. Market dynamics can change rapidly, and remaining informed is key to navigating these tumultuous waters. Keep an eye on support levels and broader economic indicators—these will shape investment strategies moving forward.