Welcome to Extreme Investor Network, where we bring you the latest updates on the companies making headlines in the world of finance. Today, we dive into the premarket trading activity of some key players in the market.

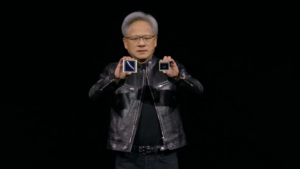

Let’s start with Nvidia, a leading artificial intelligence company, which saw its shares dip nearly 2% following news of a subpoena from the U.S. Department of Justice as part of an antitrust investigation. Despite this setback, Nvidia remains a strong player in the AI industry.

Next up is Dick’s Sporting Goods, whose stock fell about 1% despite beating Wall Street estimates in its second-quarter results. The retailer raised its full-year earnings forecast, showing confidence in its future performance.

On the flip side, Dollar Tree saw its shares plummet nearly 11% after missing revenue estimates and lowering its full-year forecast. This serves as a reminder of the importance of closely monitoring financial performance and forecasts when investing in companies.

Hormel Foods also faced challenges, with its stock dropping 8% after weaker-than-expected sales in the fiscal third quarter. The company revised its full-year guidance, underscoring the volatility in the food industry.

In more positive news, Sweetgreen’s stock rose 1.8% following a bullish upgrade from TD Cowen, highlighting the potential growth drivers for the salad chain. It’s essential to pay attention to analyst recommendations and industry trends when evaluating investment opportunities.

Zscaler, a cloud security company, experienced a sharp decline in its shares after issuing a lower-than-expected earnings forecast for the fiscal first quarter. This serves as a cautionary tale about the importance of managing investor expectations.

GitLab, a software developer, saw its stock surge 11% after exceeding Wall Street estimates in its third-quarter earnings forecast. This showcases the potential for growth in the tech sector and the importance of innovation in driving shareholder value.

AMD, a leading chipmaker, rebounded from a previous sell-off with a 2% increase in premarket trading. The semiconductor industry remains a key sector to watch for market trends and investment opportunities.

PagerDuty, a cloud computing stock, experienced a significant drop in its shares after missing revenue estimates and issuing a light forecast for the current quarter. This highlights the risks associated with investing in high-growth tech companies.

Lastly, Nordstrom saw its shares decline after a buyout offer from a buyer group that includes the company’s founding family. This development emphasizes the potential for volatility in the retail sector and the influence of stakeholders in shaping company strategies.

At Extreme Investor Network, we provide valuable insights and analysis to help you navigate the complexities of the financial markets. Stay tuned for more updates and expert commentary on the latest market trends and investment opportunities.