Unlocking the Future: Top AI Stocks to Consider Beyond Nvidia

As the AI revolution continues to reshape industries, investors are naturally keen to capitalize on the excitement surrounding this technology. While Nvidia has emerged as a standout player, the recent surge in its stock price raises concerns about overvaluation. Instead of jumping on the Nvidia bandwagon, consider exploring three robust alternatives that offer unique opportunities for growth in the AI space: IBM, Micron Technology, and Fiverr International.

1. IBM: The Enterprise AI Champion

IBM is not just about consumer-facing AI tools; the company has strategically anchored its focus on enterprise solutions. This approach allows other firms to innovate in consumer AI while Big Blue provides a rock-solid foundation with features like auditable data flows and seamless integration with business intelligence tools. These elements might not capture headlines, but they build long-term trust with large corporations and translate into stable revenue streams.

Since its launch less than two years ago, IBM’s generative AI platform has secured over $3 billion in service contracts, highlighting its growing influence. Given the ongoing digital transformation, IBM is poised to become a leader in enterprise AI, making its stock a tantalizing proposition for investors looking for stability coupled with growth potential.

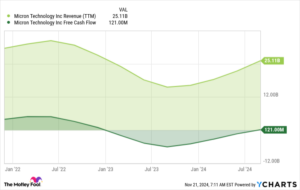

2. Micron Technology: Driving Memory Needs for AI

While Micron might not be an obvious AI investment at first glance, it plays a crucial role in the ecosystem. As a design and manufacturing powerhouse for high-speed memory chips, Micron’s products are indispensable for the massive systems that underpin generative AI. These systems require significant amounts of memory, and as smartphones increasingly adopt AI features, Micron finds itself at the heart of this technological advancement.

Despite concerns about its current valuation—trading at high multiples—Micron is projected to rebound strongly. The company reported earnings of $1.30 per share in fiscal 2024, with analysts expecting this to rise to approximately $8.93 in fiscal 2025. Underestimating Micron could mean missing out on a significant revitalization when its growth trajectory recharges.

3. Fiverr International: The Human Touch in AI

Fiverr operates on a different front in the AI landscape. Instead of hardware or infrastructure, it provides a platform that connects freelancers with clients, leveraging AI for efficiency and scale. Furthermore, Fiverr itself utilizes various AI technologies to enhance its platform. This dual approach enables it to thrive in the burgeoning gig economy while also capitalizing on the demand for AI-related freelance services.

Although Fiverr’s stock has seen fluctuations, it’s essential to note that AI-driven services are becoming a key growth driver for the company. As businesses seek to implement AI effectively, the need for skilled freelancers to navigate this new terrain will only increase.

Comparative Landscape: Key Valuations

Here’s a quick comparison of these companies alongside Nvidia for context:

| AI Stock | 2-Year Total Return | Price to Free Cash Flow | Forward Price to Earnings |

|---|---|---|---|

| Nvidia | 848% | 76.5 | 33.9 |

| IBM | 58% | 15.8 | 20.0 |

| Micron | 70% | 901.4 | 7.7 |

| Fiverr | (18%) | 13.9 | 11.6 |

The Future is Bright

While Nvidia undoubtedly leads the charge in the AI arena, its stock may have reached a point of saturation, making investors wary of potential corrections. In contrast, companies like IBM, Micron, and Fiverr represent exciting alternatives with significant growth opportunities as the AI ecosystem evolves.

Currently, there are enticing opportunities in these lesser-known stocks that Wall Street may soon recognize. Keep an eye on these companies as they build their respective revenue streams, setting the stage for future stock price appreciation.

Don’t Miss the Next Wave of AI Success

Feeling apprehensive about missing out on major investment opportunities? Our expert analysts at Extreme Investor Network are actively scouting for high-potential companies on the brink of explosive growth.

With exciting “Double Down” stock recommendations making waves, now is the perfect time to dive into potentially lucrative investments. Join us as we identify the next wave of AI successes that you won’t want to miss!

Explore 3 “Double Down” stocks today!

Note: The stock market is inherently volatile, and all investing involves risk. Always conduct due diligence or consult a financial advisor before making investment decisions.