The Upcoming Ukraine-US Mineral Deal: What You Need to Know

As the world turns its gaze towards Washington, D.C., all eyes will be fixed on the meeting between Ukrainian President Volodymyr Zelensky and U.S. President Donald Trump this Friday. Touted as a game-changer, the discussions aim to finalize a major mineral deal that has significant implications not only for Ukraine but also for global mineral markets and geopolitical dynamics.

A $1 Trillion Agreement in the Making

At the heart of the negotiations is a proposed $500 billion mineral acquisition. This hefty figure serves as a stark reminder of the financial aid the United States has extended to Ukraine amidst its ongoing conflict with Russia. The cornerstone of the agreement is a jointly managed Reconstruction Investment Fund that aims to revive Ukraine’s economy, which has been devastated by war.

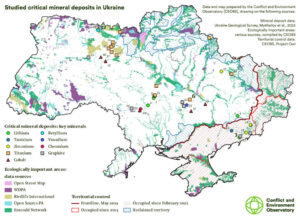

Ukraine is sitting on a treasure trove of natural resources, estimated to account for about 5% of the world’s critical raw materials. This includes a staggering 19 million tonnes of graphite reserves, as well as rich deposits of titanium, rare earth metals, and lithium. The plan proposes that up to half of Ukraine’s minerals and rare earth materials will need to be harvested to meet the demands of this ambitious deal.

President Trump has framed this deal as a way for American taxpayers to recoup some of the extensive financial assistance provided to Ukraine during the conflict. However, a contentious debate rages over whether this funding should be classified as a grant or a loan—a crucial distinction that might shape the future of U.S. involvement in the region.

The Path Ahead: Ambiguity and Security Concerns

Zelensky’s willingness to engage in this deal reveals his urgency to expedite the reconstruction of Ukraine. Yet this urgency is tempered by ongoing tensions and unmet security guarantees from the U.S. “If we don’t get security guarantees, we won’t have a ceasefire; nothing will work,” Zelensky conveyed. The situation is precarious, as NATO membership has been placed firmly off the table, leaving Ukraine seeking alternative forms of security assurance.

Interestingly, recent weeks have revealed a more collaborative approach among European leaders. They seem ready to explore ways to sustain their support for Ukraine without relying primarily on American financial aid. This evolving dynamic has prompted Zelensky to look westward for assistance while balancing the east, particularly in light of Russia’s counter-offer that suggests it possesses even more mineral resources than Ukraine.

The Bigger Picture and Implications

As negotiations unfold this week, the implications could extend beyond mere mineral extraction. Should this deal materialize, it could significantly alter America’s strategic posture in the region and influence global markets for critical minerals.

Additionally, a successful agreement could pave the way for a more stable post-war Ukraine, providing much-needed economic revitalization and infrastructure development. Yet, failure to secure the promised security guarantees may lead to continued instability, making the stakes incredibly high for both parties involved.

In conclusion, the forthcoming discussions between Zelensky and Trump could act as a watershed moment in not only the U.S.-Ukraine relationship but also in the broader geopolitical landscape. Keep an eye on our Extreme Investor Network blog for real-time updates and in-depth analyses as this critical narrative unfolds. With layers of economic implications and international relations at stake, your understanding of these developments could not be more crucial. Stay informed, stay engaged!