Asian Markets React to President-Elect Trump’s Policy Agenda

As traders across Asia brace themselves for the impact of president-elect Donald Trump’s likely policy agenda and the strengthening dollar on regional economies, the MSCI Asia Pacific Index saw a dip for the third consecutive day. This decline comes in the wake of rising Treasury yields, posing a potential threat to divert funds back to US assets. With Hong Kong shares leading the downward trend, reports of Trump’s cabinet including several China hawks have added to investor uncertainties.

The ‘Trump trade’ phenomenon that results in a boost for the dollar and US stocks is not expected to have the same positive impact on assets in other parts of the world. Trump’s plans to increase tariffs may have adverse effects on many economies globally, particularly countries like China that heavily rely on exports to the US.

Phillip Wool, head of portfolio management at Rayliant Global Advisors, highlighted the growing concerns among investors, citing apprehensions about the potential implications of Trump’s policies on global trade relations and their impact on Asian shares.

Meanwhile, Treasury 10-year yields saw an uptick, climbing three basis points to 4.34%, while the Bloomberg Dollar Spot Index witnessed a 0.2% gain after reaching a one-year high. Oil prices remained relatively stable after experiencing their largest drop in a fortnight.

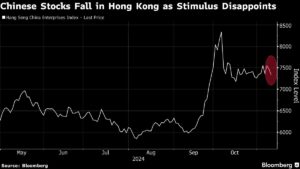

Hong Kong’s Hang Seng Index faced a significant decline due to uncertainties surrounding Trump’s China policies and disappointment over Beijing’s recent stimulus strategies. Homin Lee, senior macro strategist at Lombard Odier, pointed out that the market sentiment in Hong Kong has been affected by Trump’s reported commitment to punitive tariffs on Chinese exports to the US.

In China, the benchmark CSI 300 Index experienced a setback despite initial support from reports suggesting tax cuts for home purchases as part of efforts to revive the sluggish housing market. However, doubts persist about the effectiveness of these measures to stimulate consumer demand in the country.

Looking ahead, results from tech giants Tencent Holdings Ltd. and Alibaba Group Holding Ltd. in the upcoming week will provide insights into how their streamlining efforts and cost-saving measures have sustained them during the economic downturn until Beijing’s stimulus measures reinvigorate consumer spending.

As US inflation figures are scheduled for release later in the week, investors are keeping a close watch on the potential impact on market trends. JPMorgan Chase & Co. analysts predict that US stocks could witness stronger gains at the end of the year following Trump’s election victory compared to his previous win eight years ago.

At Extreme Investor Network, we provide in-depth analysis and insights into the latest financial trends and market developments. Stay ahead of the curve with our expert commentary and tailored investment advice. Join our community today and elevate your financial acumen to new heights.