Welcome to Extreme Investor Network, where we provide you with the latest updates and insights in the world of finance. Today, we are diving into European stocks rebounding after days of political upheaval in France. Traders are gearing up for potential disruptions from US inflation data just hours ahead of the Federal Reserve’s interest rate decision.

After three sessions of losses, banks led a 0.5% advance in the Stoxx 600, marking a positive turn for European stocks. The euro held steady, and treasuries remained stable following a $39 billion sale. Meanwhile, the dollar remained strong after four days of gains, and US stock futures edged higher.

The calm in European assets following the unexpected gains of the far-right party in the European Parliament elections may be short-lived. A double-whammy of US CPI data and Fed rate forecasts could potentially upend markets, setting the global market mood for the rest of the month and even the summer.

“Ipek Ozkardeskaya, an analyst at Swissquote Bank, commented, ‘Today is a big day in terms of economic data and Fed announcement. It could determine the global market mood for the rest of the month, and a good part of summer.'”

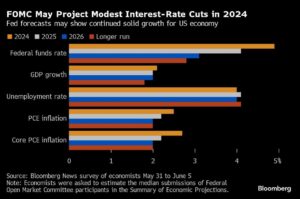

As investors eagerly anticipate the Fed’s interest rate decision, there is less certainty on the officials’ quarterly rate projections, known as the “dot plot.” The new dot plot is expected to indicate two 25-basis-point cuts this year, down from three in the March version, according to Bloomberg Economics.

In Asia, Hong Kong’s equity benchmark fell more than 1%, and China’s consumer price gains remained above zero in May while factory-gate prices stayed in deflation. There are concerns over persistently weak demand, and the Biden administration is reportedly considering further restrictions on China’s access to chip technology used for artificial intelligence.

Key events to watch for this week include the US CPI data and Fed rate decision on Wednesday, the G-7 leaders summit from June 13-15, Eurozone industrial production on Thursday, and various speeches and reports throughout the week.

Stay tuned to Extreme Investor Network for more updates on market movements, key events, and expert insights in the world of finance. Subscribe now to stay ahead of the curve and make informed investment decisions.