The latest market update on Asian equities begins with a rise, especially in the shares of AI chipmaker Taiwan Semiconductor Manufacturing Co, as reported by Bloomberg. Investors saw a rise in shares in Japan, aided by a weaker yen, while shares in China saw fluctuations and stocks in Australia fell. The sharp rally of TSMC on Thursday led to a surge of as much as 6.3% in opening trade, positioning the benchmark for its first daily advance since last week.

As investors focus on China, key economic data is expected to be unveiled, including gross domestic product data for the third quarter. With home prices showing a slower pace of decline and indications that Beijing’s supportive measures are effective, investors are eagerly awaiting industrial production and retail sales data for more insights.

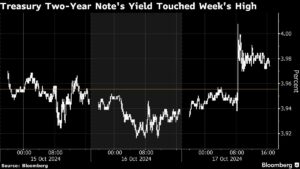

Swaps traders have reduced bets on Federal Reserve rate cuts in the remaining two meetings of the year, leading to steady Treasuries after a jump in yields on Thursday. The robust US retail sales in September exceeded expectations, showcasing resilient consumer spending that continues to fuel the economy. This data, along with other strong economic indicators released this month, paints a positive picture of the US economy’s health.

In Japan, headline inflation rose as expected, and the yen saw some strength, with the risk of official intervention inching closer. The US economy also saw a string of stronger-than-estimated data, pushing Citigroup’s Economic Surprise Index to its highest since April. This retail sales data underscores undeniable strength across the economy, prompting discussions about the direction of monetary policy moving forward.

Aside from economic updates, commodities also saw movements, with gold climbing to a fresh record amid ongoing tensions in the Middle East and West Texas Intermediate, the US crude price, edging higher.

Looking ahead this week, key events to watch out for include China’s GDP data, US housing starts, and speeches from Fed officials Christopher Waller and Neel Kashkari.

In summary, the Asian equity market saw positive movements, and the economic landscape in both the US and China continues to show signs of strength. Stay tuned for more updates as market dynamics evolve.