The latest economic data has sparked optimism in the markets, fueling expectations for Federal Reserve interest-rate cuts. Asian stocks surged as the MSCI Asia-Pacific index reached a two-year high, with technology shares leading the rally. Markets in Japan, South Korea, Taiwan, and Australia all saw gains, while US futures remained steady after the S&P 500 and Nasdaq 100 hit records ahead of a holiday.

The yen saw a rebound after hitting its lowest level against the dollar since 1986, with speculation swirling about the Bank of Japan’s approach to policy tightening. A weaker dollar and lower Treasury yields have bolstered risk sentiment across the region, with many experts now predicting a September rate cut.

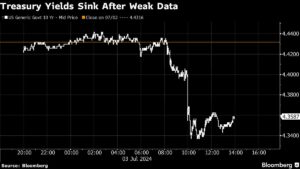

In the US, soft economic data has reignited talks of rate cuts, following reports of a contracting services sector and signs of a weakening labor market. Minutes from the Federal Reserve’s June meeting revealed a mixed sentiment among officials, with swap traders anticipating potential rate cuts as early as November.

The upcoming US jobs report will be closely monitored by investors, as economists predict a modest gain in non-farm payrolls for June. This data could play a pivotal role in the Fed’s decision-making process regarding interest rates.

Gold prices have risen for a second day, breaking out of a recent trading range, while iron futures have climbed on optimism for increased demand from China. With key events like the UK general election and US Independence Day holiday looming, market volatility is expected to persist in the coming days.

Stay informed with Extreme Investor Network for the latest updates on global markets, economic trends, and investment insights. Our expert analysis and unique perspectives will help you navigate the ever-changing financial landscape with confidence and clarity. Join our network of savvy investors today and take your investment game to the next level.