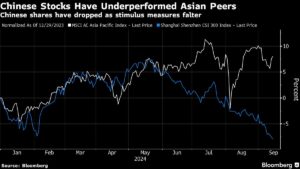

The markets in Asia struggled to find direction on Monday as traders digested the latest economic data out of China. The country’s factory output, consumption, and investment all slowed more than expected for August, while the jobless rate unexpectedly hit a six-month high. This has raised concerns about the strength of China’s economy and the potential need for additional stimulus measures from authorities.

In response to the data, Australia’s benchmark index edged up in early trade, while US futures showed incremental gains. However, Hong Kong shares were bracing for declines amid worries about the implications of the weak Chinese data. Meanwhile, Japan and mainland China were closed for a holiday, adding to the subdued trading atmosphere in the region.

The dollar was lower following news of an apparent assassination attempt against former President Donald Trump, adding to the uncertainty in the markets. With a slew of data releases and central bank decisions on the horizon, including an expected rate cut by the Federal Reserve, investors are closely watching for clues on the direction of markets for the rest of the year and into 2025.

Amidst the uncertainty, global funds have been turning to Southeast Asian assets, enticed by the prospect of interest rate cuts and attractive valuations. Should the Fed’s rate cut be non-recessionary driven, currencies such as the Korean won, Malaysian ringgit, and Thai baht could outperform the US dollar.

Key events this week include a Eurozone inflation reading, a rate cut by the Federal Reserve, and policy decisions from the Bank of England and Bank of Japan. The market is also anticipating US business inventories, industrial production, and retail sales data, along with rate decisions from central banks in Canada, Indonesia, South Africa, Norway, and the UK, among others.

In the midst of all this market activity, traders will likely remain cautious as they await further developments. The coming days promise to be eventful, with a potential for significant market movements based on the outcome of central bank decisions and economic data releases.

Stay tuned to Extreme Investor Network for timely updates and expert analysis on the latest developments in the finance and investment world. Our team of experts is dedicated to providing valuable insights and actionable information to help you navigate the ever-changing landscape of global markets. Subscribe to our newsletter to stay ahead of the curve and make informed investment decisions.